The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

On a Week 45, the MABUX World Bunker Index returned to the path of moderate growth. Index 380 HSFO rose by 4.88 USD: from 517.42 USD / MT to 522.30 USD / MT. The VLSFO index increased by 10.71 USD (having fully recovered from the losses the previous week): from 644.79 USD / MT to 655.30 USD / MT, while the MGO index added 9.42 USD (rising from 768.32 USD / MT to 777.74 USD / MT).

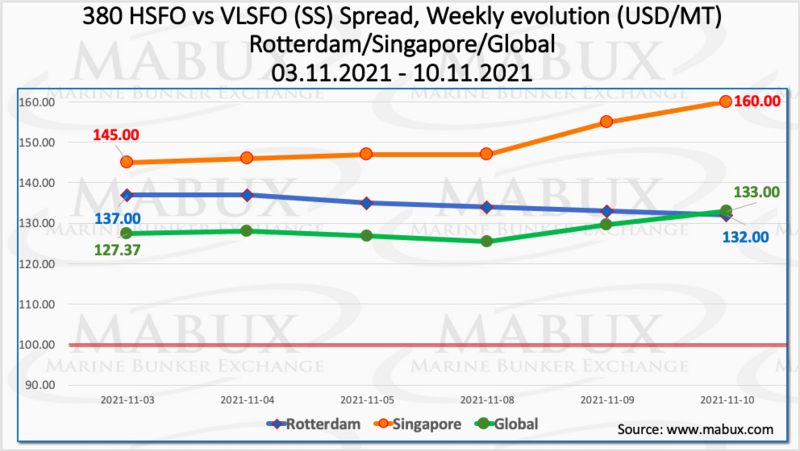

The average weekly Global Scrubber Spread (SS) - the difference in price between 380 HSFO and VLSFO - rose slightly during the week and reached $ 128.41 (versus $ 127.35 last week, plus $ 1.06). At the same time, the average SS Spread in Rotterdam dropped to $ 134.67 (versus $ 137.50 last week, minus $ 2.83), while the average SS Spread in Singapore, on the contrary, added $ 5.83 and reached $ 150.00 (the first time since Feb.27.2020) against $ 144.17 last week. In general, all SS Spread indicators are currently consistently above the psychological mark of $ 100. More information is available in the Differentials section on the web-platform www.mabux.com.

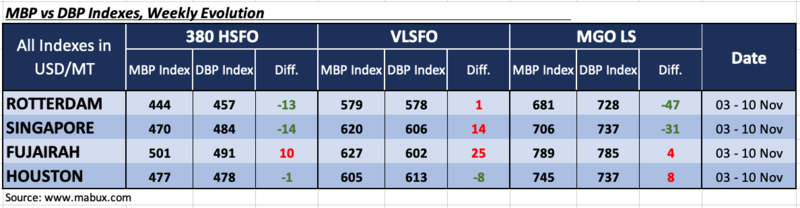

Correlation of MABUX MBP Index (Market Bunker Prices) vs MABUX DBP Index (MABUX Digital Benchmark) in the four global largest hubs over the past week showed that 380 HSFO fuel remained overvalued in only one port - Fujairah (plus $ 10). In all other ports, the MABUX MBP / DBP Index registered an underestimation of the fuel grade: in Rotterdam - by minus $ 13, in Singapore - by minus $ 24 and in Houston - by minus $ 1. In general, the the underestimation rates of the 380 HSFO have not change significantly.

VLSFO fuel grade, according to the MABUX MBP / DBP Index, has been overpriced at three out of four selected ports while Singapore joined Rotterdam and Fujairah. The overcharge margins were registered as: in Rotterdam - plus $ 1, in Singapore - plus $ 14 and in Fujairah - plus $ 25. The only port, according to the MABUX MBP / DBP Index, where VLSFO fuel was underestimated, was Houston - minus $ 8.

As for the MGO LS, the MABUX MBP / DBP Index has registered a transition of the price indicators to the overcharge segment in two ports at once: in Fujairah - plus $ 4 and in Houston - plus $ 8. At the same time, MGO LS fuel grade remains undervalued in Rotterdam - minus $ 47 and in Singapore - minus $ 31.

The European Community Shipowners’ Association (ECSA) has issued a new policy paper in which it calls for vessel operators to bear the costs of the EU Emissions Trading System (EU ETS). In the paper, ECSA also voices its ‘firm support’ of establishing a dedicated fund under the EU Emissions Trading System (EU ETS) to stabilise the carbon price. In fact, ECSA supports that the commercial operator should bear the costs of the EU ETS. The law should require the entity responsible for the decisions affecting the CO2 emissions of a ship to bear the costs arising from the implementation of the EU ETS in the context of a contractual agreement. European shipowners propose the introduction of a legally binding requirement in the articles of the EU ETS proposal which it said should provide for passing through the costs of the system from the shipping companies to the commercial operators in the context of a contractual agreement.

Source: www.mabux.com

All news