The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

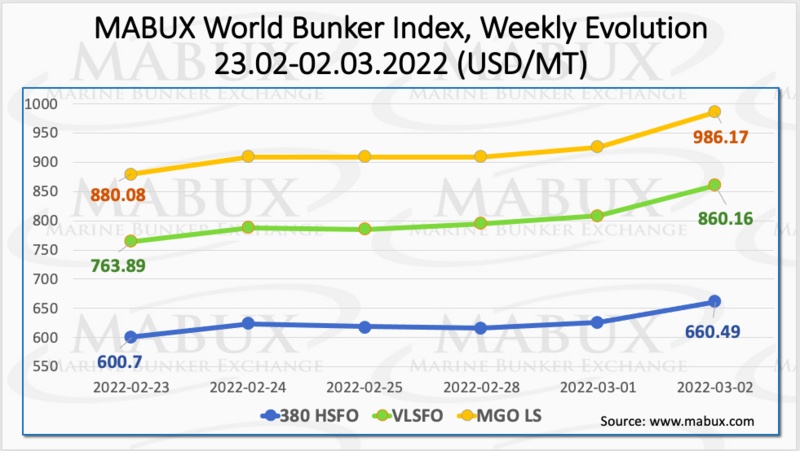

Bunker fuel prices have risen significantly over a Week 09 as Russia-Ukraine conflict continues to escalate. The 380 HSFO Index rose by 59.79 USD: from 600.70 USD/MT to 660.49 USD/MT. The VLSFO index jumped by 96.27 USD: from 763.89 USD/MT to 860.16 USD/MT. The MGO index showed the most significant growth: by 106.09 USD (from 880.08 USD/MT to 986.17 USD/MT). The market remains highly volatile.

The Global Scrubber Spread (SS) weekly average - the difference in price between 380 HSFO and VLSFO - also showed a sharp increase over the week: plus $11.78 ($175.91 vs. $164.13 last week). Meantime, in Rotterdam, the SS Spread weekly average increased from $166.67 to $177.00 (up $10.33 compared to the week before) and added 42 points in an absolute value. In Singapore, the SS Spread average also continued to rise: plus $7.33 from $215.17 to $222.50 (up 47 points in absolute value). More information is available in the Price Differences section at mabux.com.

Gas prices in Europe have soared amid confrontation in Ukraine, and suppliers are not able to indicate LNG as a bunker fuel at the moment.

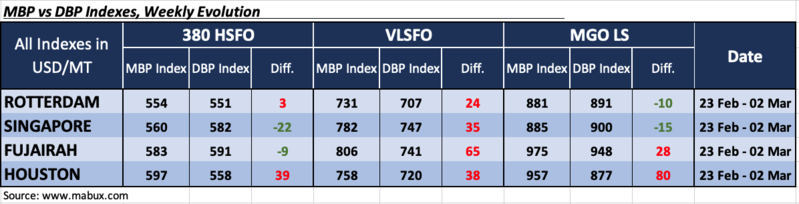

Over the Week 09, the average correlation of MABUX MBP Index (market bunker prices) vs MABUX DBP Index (MABUX digital bunker benchmark) showed that 380 HSFO fuel grade remained overpriced in two out of four ports selected: in Rotterdam - plus $ 3 and in Houston - plus $39. In Singapore and Fujairah, the MABUX MBP/DBP Index registered an underpricing by $22 and $9 respectively. The persisting volatility in the market prevents the formation of a sustainable trend.

VLSFO fuel grade, according to the MABUX MBP/DBP Index, remains on average significantly overpriced at all selected ports: plus $24 in Rotterdam, plus $35 in Singapore, plus $65 in Fujairah and plus $38 in Houston. The most significant change over the week was the reduction of VLSFO overprice ratio at the port of Houston by 27 points.

As for MGO LS, the MABUX MBP/DBP Index registered an underestimation of this fuel grade in two out of four selected ports: in Rotterdam by minus $ 10 and in Singapore by minus $ 15. In Fujairah and Houston, the MGO LS overcharged by $ 28 and $ 80, respectively, while in Houston the overpricing premium rose by 33 points at once.

Europe’s biggest port, the Port of Rotterdam, says the sanctions imposed on Russia are having a ‘rather limited impact’, noting that extensive imports of energy, such as crude oil, oil products, LNG and coal, are yet to be targeted. Of the roughly 470 million tonnes transshipped through the port of Rotterdam, 62 million tonnes (13%) are oriented towards Russia. Large amounts of energy carriers are imported from Russia via the Port of Rotterdam, which currently comes to roughly 30% of Russian crude oil, 25% of LNG, and 20% of oil products and coal. In terms of trade restrictions, Russia exports products such as steel, copper, aluminium and nickel via Rotterdam. The port said these are not as yet under the trade restrictions announced by the European Union.

Russia-Ukraine conflict continues to prompt uncertainty on Global bunker market. We expect bunker fuel prices to be unstable while more upward variations may prevail next week.

By Sergey Ivanov, Director, MABUX