IAA PortNews and the Institute for Natural Monopolies Research (IPEM) present infographics and analytics on operation of Russian seaports in Q2’ 2022

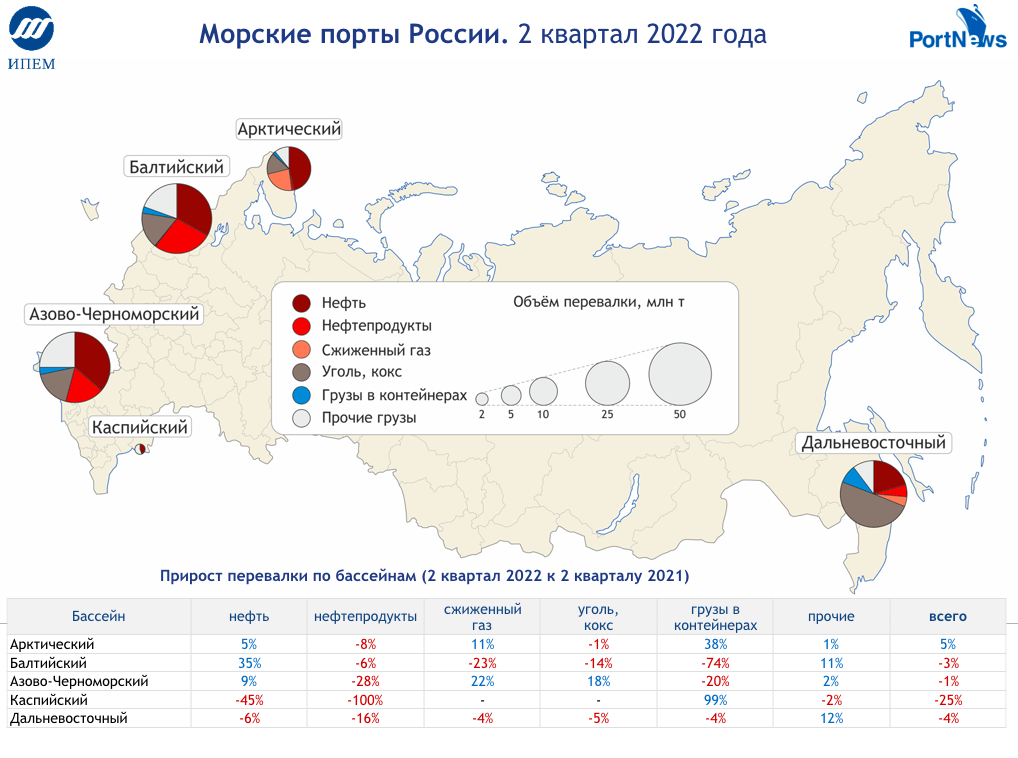

In the second quarter 2022, cargo handling in Russian ports fell by 2.1%, year-on-year, to 209.8 million tonnes. It is the first decrease of quarter results from QI’2021. The fall should be attributed to the turbulence of economic relations between Russia and Europe, the USA and other countries.

In the second quarter 2022, cargo handling in Russian ports fell by 2.1%, year-on-year, to 209.8 million tonnes. It is the first decrease of quarter results from QI’2021. The fall should be attributed to the turbulence of economic relations between Russia and Europe, the USA and other countries.

The steepest fall was shown by containerized cargo (-39%) due to the two main factors: reduction of foreign-owned containers available for use and steeper fall of container imports as compared with exports amid sanctions and restrictions.

Considerable decrease was registered in the segment of oil products (-16%) and ferrous metal (-17%) – key commodities import of which is already covered by restrictions imposed by the EU (excluding crude oil). The decrease of coal and coke handling is less (-3%), since the official restrictions on supply of Russian coal to Europe come into effect only in August.

Handling of crude oil increased considerably (+11%), due to the low base of 2021 and relatively wide opportunities for supplies of this commodity to other markets (as compared with oil products and ferrous metal). Exports of liquefied gas also showed a moderate growth (+5%) as they are not covered by foreign countries’ restrictions yet.

Handling of crude oil increased considerably (+11%), due to the low base of 2021 and relatively wide opportunities for supplies of this commodity to other markets (as compared with oil products and ferrous metal). Exports of liquefied gas also showed a moderate growth (+5%) as they are not covered by foreign countries’ restrictions yet.

Essential growth was registered in handling of fertilizers (+22%), grain (+24%) and ore (+40%) which was driven by the increase of global prices, absence of import restrictions and launching of a new terminal for shipment of fertilizers and ore, Ultramar terminal on the shore of the Gulf of Finland.

The decrease was seen in all basins except the Arctic one which showed a 5-pct growth due to the increase of crude oil and liquefied gas exports. In the Baltic and the Azov-Black Sea basins, the fall in handing of containers and oil products was partly offset by the growth of crude and grain exports, hence a relatively small decrease (-3% and -1% accordingly). In the Far East Basin, cargo handling fell in most segments (-4%). The major fall was registered in the Caspian Basin (-25%): small volumes of cargo turnover are volatile due to local reasons.

When using the review materials, reference to the joint project of IPEM and PortNews is required.