The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

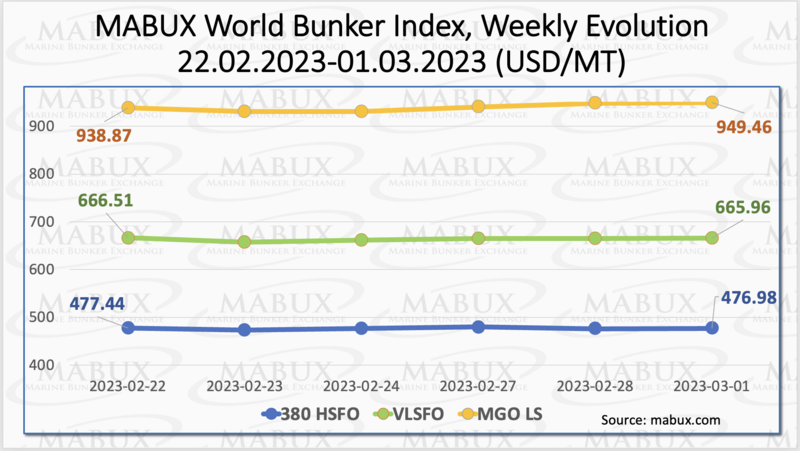

Over the Week 09, MABUX global bunker indices did not have a firm trend and changed sideways. The 380 HSFO index decreased by 0.46 USD: from 477.44 USD/MT last week to 476.98 USD/MT. The VLSFO index, in turn, fell by 0.55 USD (665.96 USD/MT versus 666.51 USD/MT last week). The MGO index, on the contrary, showed an increase by 10.59 USD (from 938.57 USD/MT last week to 949.46 USD/MT). At the time of writing, irregular fluctuations prevailed in the Global bunker market.

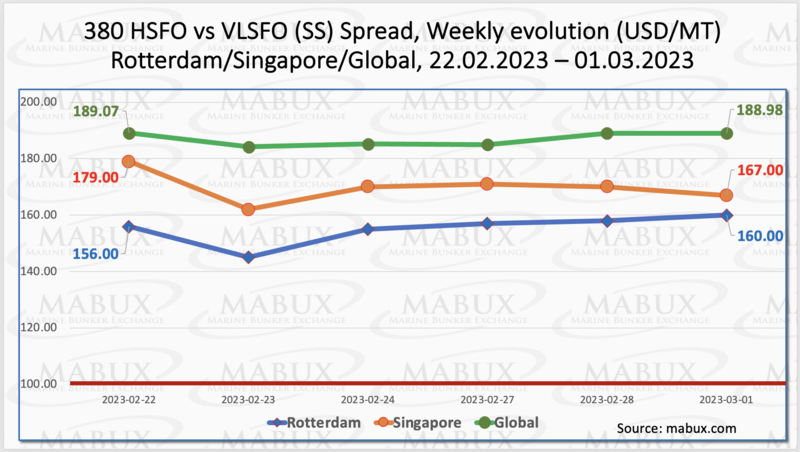

Global Scrubber Spread (SS) – the price differential between 380 HSFO and VLSFO - had no significant changes in a week 09 – minus $ 0.09 ($ 188.98 vs. $ 189.07 last week), being steadily below $ 200 mark. Meantime, the weekly average was down $13.52. In Rotterdam, SS Spread rose by $4.00 to $160.00 (vs. $156.00 last week), but the weekly average was down $19.00. In Singapore, the 380 HSFO/VLSFO price difference showed the most significant reduction: minus $12, dropping to $167. The weekly average fell by $32.17. We expect SS Spread to continue downward trend next week. More information is available in the "Differentials" section of www.mabux.com.

Europe, previously reluctant to commit to long-term gas deals due to climate goals and emissions considerations, is now installing floating storage regasification units (FSRUs) to welcome LNG cargoes that are replacing Russian pipeline gas supply. The surge in LNG demand in Europe is set to intensify competition with Asia in the short term and dominate LNG trade in the longer term.

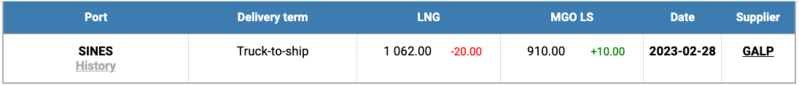

The price of LNG as a bunker fuel at the port of Sines (Portugal) continued its moderate decline and reached 1062 USD/MT on February 28 (minus 20 USD compared to the previous week). The difference in price between LNG and conventional fuel on February 28 was 152 USD: MGO LS at the port of Sines was 910 USD/MT that day. The price difference continues to gradually decrease. We expect this trend to continue next week. More information is available in the “LNG Bunkering” section at www.mabux.com.

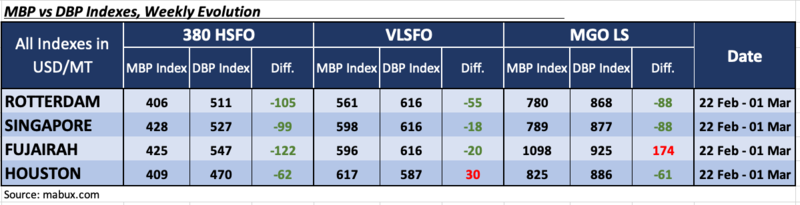

Over the Week 09, the MDI index (correlation of MABUX market bunker prices (MBP Index) vs MABUX digital bunker benchmark (DBP Index) registered fuel 380 HSFO underestimated in all four selected ports. The average underestimation ratio continued to decrease and amounted to: in Rotterdam – minus $105, Singapore - minus $99, Fujairah – minus $122 and Houston – minus $62. The most significant narrowing of SS Spread was recorded at Fujairah - minus $30.

In the VLSFO segment, according to MDI, the three selected ports – Rotterdam, Singapore and Fujairah – remain underpriced by minus $55, minus $18 and minus $20, respectively. The underestimation weekly average at all three ports increased moderately. Houston remained the only overvalued port in this fuel segment – plus $30, while the overpricing rate widened as well.

There are three underestimated ports in the MGO LS segment: Rotterdam, Singapore and Houston. The weekly average underpricing premium widened moderately and amounted to minus $88, minus $88 and minus $61, respectively. Fujairah remained the only overvalued port - plus $174. The most significant change in this bunker fuel segment was an increase of the average undervaluation ratio at Houston by 19 points.

More information on the correlation between market prices and MABUX digital benchmark is available in the “Digital Bunker Prices” section at www.mabux.com.

The Port of Rotterdam has reported that while the war in Ukraine ‘led to unprecedented changes in goods flows last year’, the total throughput was down just 0.3% at 467.4 million tonnes. In the container sector throughput fell by 5.5% in TEUs – this was ‘mainly because container traffic to and from Russia came to a virtual standstill after the conflict in Ukraine’. Meanwhile imports of LNG, mainly from the USA, increased by 63.9% - and this was because Europe has been looking for alternatives to Russian gas. Summarising the outlook for the coming year, the Port Authority said that ‘the current geopolitical situation is a source of major uncertainty’, inflation has ‘risen sharply’ and the economy of the Netherlands and Europe are likely to ‘stagnate in 2023’. Consequently, the Port Authority expected that throughput volumes are to ‘decline slightly’.

The global bunker market is in the phase of a sustainable trend formation. We expect the global bunker indices to remain rangebound next week.

By Sergey Ivanov, Director, MABUX

All news