The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

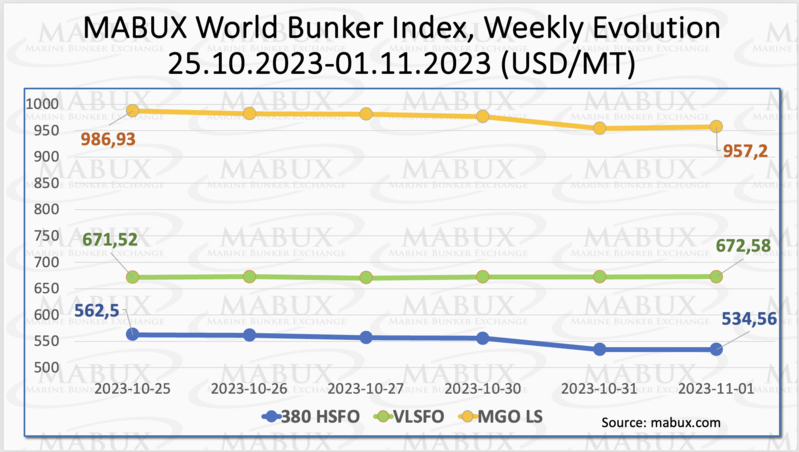

During Week 44, the MABUX global bunker indices exhibited erratic fluctuations with no clear sustained trends. The 380 HSFO index declined by $27.94, dropping from $562.50 USD/MT the previous week to $534.56 USD/MT. Conversely, the VLSFO index increased by $1.06, reaching $672.58 USD/MT compared to $671.52 USD/MT the previous week. The MGO index saw a significant decrease of $29.73, going from $986.93 USD/MT last week to $957.20 USD/MT. At the time of writing, market trends remain uncertain.

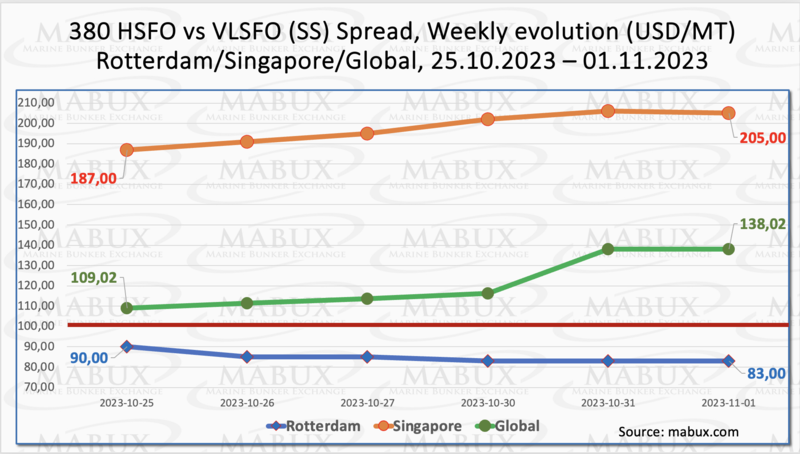

Global Scrubber Spread (SS) - the price difference between 380 HSFO and VLSFO - showed a significant increase: plus $29.00 ($138.02 vs. $109.02 last week), still consistently above the $100.00 mark (the SS breakeven point). At the same time, the weekly average also increased by $11.01. In Rotterdam, on the contrary, the SS Spread decreased by $7.00 (from $90.00 last week to $83.00), but the average value saw a slight increase of $1.16. Thus, the SS Spread in Rotterdam is stably below the $100.00 mark, due to relatively high prices for 380 HSFO, combined with limited availability resulting from shipping delays and congestion at oil terminals in the ARA region. In Singapore, the price difference between 380 HSFO and VLSFO increased by $18.00, surpassing the $200.00 mark ($205.00 versus $187.00 last week). The weekly average also increased by $10.34.

We expect SS Spread will continue to rise moderately in the upcoming week. More information is available in the “Differentials” section of www.mabux.com.

According to Montel, LNG imports into northwest Europe are projected to surge by 30% in November compared to October, driven by anticipated higher demand at the start of the heating season. In the coming month, northwest Europe is expected to receive approximately 243 million cubic meters per day (mcm/day) of LNG, destined for the Netherlands, France, Germany, and the UK. These estimates for November indicate a 15% decrease compared to the same month in 2022. The pivotal factors influencing LNG imports into Europe in the months ahead will be weather conditions and weather forecasts. They will play a significant role in shaping European gas consumption during this winter and are currently the largest variables in the equation. European gas consumption has seen a reduction over the past year due to energy conservation efforts and decreased industrial demand, which can be attributed to high energy prices and demand constraints.

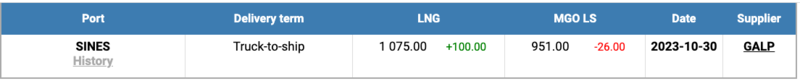

The cost of LNG as bunker fuel at the port of Sines, Portugal, witnessed an upward trend, reaching $1,075 per metric ton on October 30th. This represents a significant increase of $100 compared to the previous week. Notably, the price balance between LNG and conventional fuel on October 30th has shifted back in favor of MGO, with a $124 advantage, as opposed to the $8 advantage in favor of LNG just one week earlier. On that day, MGO LS was quoted at 951 USD/MT in the port of Sines. More information is available in the LNG Bunkering section of www.mabux.com.

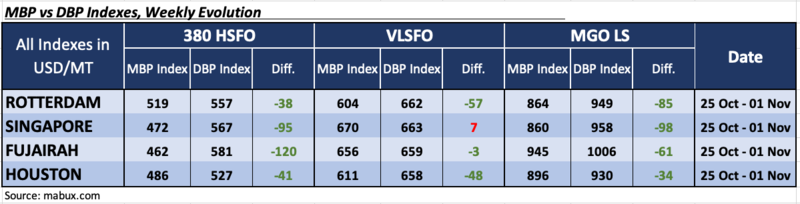

During Week 44, the MDI index (the ratio of market bunker prices (MABUX MBP Index) vs. the MABUX digital bunker benchmark (MABUX DBP Index)) revealed the following trends in four selected ports: Rotterdam, Singapore, Fujairah and Houston:

In the 380 HSFO segment, all four ports remained undervalued. The average weekly underpricing increased by 4 points in Rotterdam, 8 points in Singapore, 5 points in Fujairah and 9 points in Houston. In Fujairah, the underpricing level of this fuel type still exceeded the $100 mark.

In the VLSFO segment, according to MDI, Singapore remained the only overvalued port. The average overpricing increased by 6 points during the week. In the other three ports, VLSFO was underestimated. Undercharge weekly average increased by 1 point in Rotterdam but decreased by 10 points in Fujairah and 3 points in Houston. Fujairah was close to the 100% correlation between market prices and the digital benchmark.

In the MGO LS segment, all ports showed undervaluation, with the weekly average decreasing in Rotterdam by 4 points, in Fujairah by 11 points and in Houston by 4 points. In Singapore, the average MDI index increased by 3 points.

More information on the correlation between market prices and the MABUX digital benchmark is available in the “Digital Bunker Prices” section of www.mabux.com.

According to a report from the Economist Intelligence Unit, global energy and fossil fuel consumption are expected to reach a new record high in 2024, despite ongoing conflicts and high prices. This surge in consumption is primarily driven by robust demand in Asia. In the coming year, global energy consumption is projected to grow by 1.8%. The report's authors noted that, despite the persistence of high prices and unresolved supply chain disruptions, demand for fossil fuels will hit unprecedented levels, while demand for renewable energy is anticipated to increase by 11%. Specifically, there is an expected 1.7% rise in oil demand in the next year, with natural gas demand set to grow by 2.2%, led by Asia and the Middle East. In contrast, Europe is likely to continue experiencing reduced demand as it focuses on conserving gas and energy. Renewable energy capacity additions are poised to reach a historical high this year, with approximately 400 gigawatts (GW) expected, and this trend is set to continue into 2024. Earlier, OPEC forecasted that global oil demand would increase by 2.4 million barrels per day (bpd) this year, reaching a new record high, and then further rise by another 2.2 million bpd in the following year. This forecast remains unchanged, despite concerns about slowing economies and potential demand reduction. According to OPEC, world oil demand is projected to average 102.1 million bpd in 2023, with a significant portion of the 2.3-million-bpd demand increase occurring in the non-OECD region.

The escalation of the conflict in the Middle East is contributing to a high level of volatility in the global bunker market, hindering the formation of sustained trends. We expect the bunker indices to continue significant irregular fluctuations in the coming week.

By Sergey Ivanov, Director, MABUX