The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

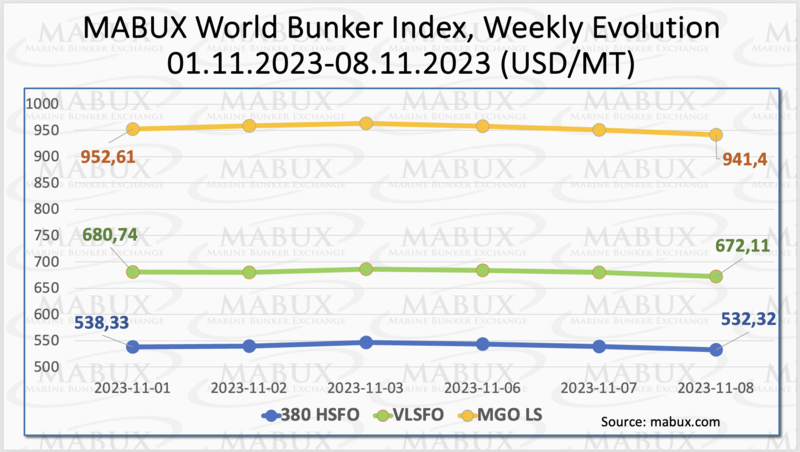

During Week 45, the MABUX global bunker indices, following a brief period of moderate growth, once again shifted towards a downward trajectory. The 380 HSFO index fell by 6.01 USD: from 538.33 USD/MT last week to 532.32 USD/MT. The VLSFO index, in turn, lost 8.63 USD (672.11 USD/MT versus 680.74 USD/MT last week). The MGO index decreased by 11.21 USD (from 952.61 USD/MT last week to 941.40 USD/MT). At the time of writing, the market displayed no consistent trend.

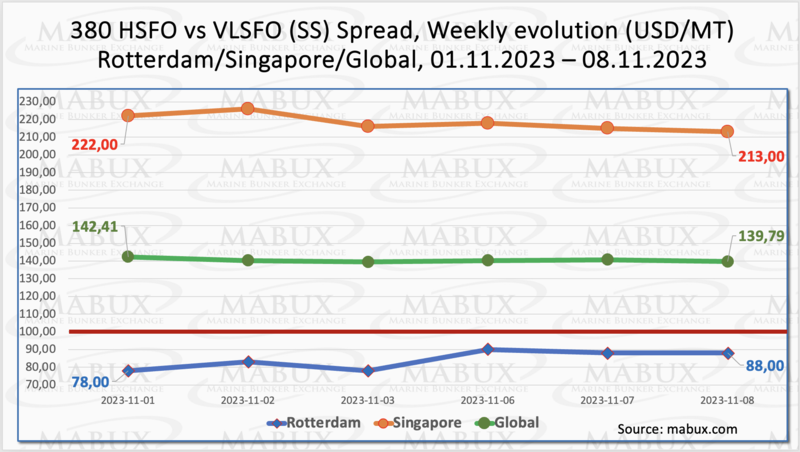

Global Scrubber Spread (SS) - the price difference between 380 HSFO and VLSFO – slightly decreased: minus $2.62 ($139.79 versus $142.41 last week), still remaining firmly above the $100.00 mark (SS breakeven). Meantime, the weekly average increased by $19.33. In Rotterdam, the SS Spread rose by $10.00 (from $78.00 last week to $88.00), while the weekly average remained nearly unchanged at minus $0.66. In Singapore, the price difference between 380 HSFO and VLSFO decreased by $9.00, still remaining above the $200.00 mark ($213.00 versus $222.00 last week), and the weekly average showed an increase of $20.66. We expect that, due to the high volatility in the market, SS Spread will not have a sustainable trend in the coming week. More information is available in the “Differentials” section of www.mabux.com.

European countries have begun storing gas in Ukraine as their own storage caverns reach capacity due to the regasified LNG acquired earlier this year. Nearly 30 LNG tankers are en route to European ports and are scheduled to arrive by the end of the month. Among them are three Russian vessels transporting liquefied gas, despite the EU's prior assertions of reducing dependence on Russian hydrocarbons. Nevertheless, gas consumption in the EU is expected to remain limited, regardless of the gas in storage or new LNG shipments. One contributing factor is the tight global LNG market, which has arisen as Europe transitions to liquefied fuel to replace over 100 billion cubic meters of Russian pipeline gas that is no longer available. Moreover, it appears premature to reiterate last year's declarations that the EU could entirely do without gas and solely rely on wind, solar, nuclear, hydro, and possibly hydrogen in their energy mix.

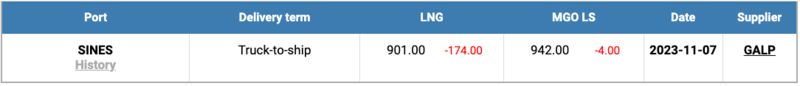

The price of LNG as bunker fuel at the port of Sines (Portugal) has resumed its decline, dropping to 901 USD/MT on November 07 (minus 174 USD compared to the previous week). Thus, the price gap between LNG and conventional fuel on November 07 has once again shifted in favor of LNG: 41 USD versus 124 USD in favor of MGO a week earlier. MGO LS was quoted that day in the port of Sines at 942 USD/MT. More information is available in the LNG Bunkering section of www.mabux.com.

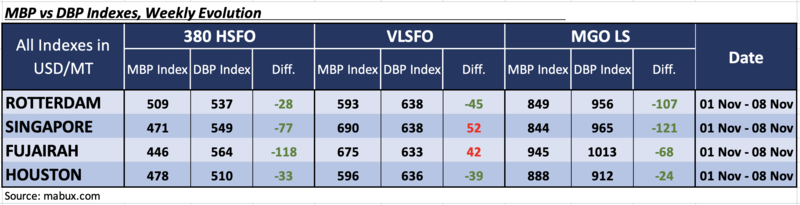

During Week 45, the MDI index (the ratio of market bunker prices (MABUX MBP Index) vs. the MABUX digital bunker benchmark (MABUX DBP Index)) recorded the following trends in four selected ports: Rotterdam, Singapore, Fujairah and Houston:

In the 380 HSFO segment, all four ports remained undervalued. The average weekly underpricing fell by 10 points in Rotterdam, 18 points in Singapore, 2 points in Fujairah and 8 points in Houston. In Fujairah, the underpricing of this type of fuel continues to exceed the $100 mark.

In the VLSFO segment, according to MDI, Fujairah moved into the overcharge zone, joining Singapore. The average overpricing increased by 45 points in Singapore and 44 points in Fujairah. In Rotterdam and Houston, VLSFO remained undervalued, with average weekly levels decreasing by 12 points in Rotterdam and 9 points in Houston.

In the MGO LS segment, all ports were undervalued, with the weekly average increasing in Rotterdam by 22 points, in Singapore by 23 points and in Fujairah by 7 points. In Houston, the average MDI index decreased by 10 points.

Overall, significant fluctuations in the MDI index point to considerable market volatility.

More information on the correlation between market prices and the MABUX digital benchmark is available in the “Digital Bunker Prices” section of www.mabux.com.

As per DNV’s recent Report, there were 14 orders for methanol-powered vessels in October. With these new orders, the total number of confirmed orders for methanol-fueled vessels has now reached 230. In the same month, there were also six orders for LNG-powered vessels, bringing the total number of confirmed LNG ships to 984. Notably, DNV highlighted the first confirmed order for two ammonia dual-fuel systems. DNV pointed out that, similar to the initial orders for LNG, methanol, and LPG-powered vessels, the early orders for ammonia-fueled vessels are designed to transport the same fuel as cargo. What sets this development apart is the increased momentum for alternative fuels in general and the specific drive for ammonia as a fuel. This momentum is stronger compared to the early stages of LNG and methanol adoption. There are already orders for other ship types, even before the maritime community gains operational experience with gas carriers using ammonia as a fuel.

The global bunker market remains highly unpredictable, preventing the formation of stable trends. Irregular changes in bunker indices are expected to dominate the market in the upcoming week.

By Sergey Ivanov, Director, MABUX

All news