The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

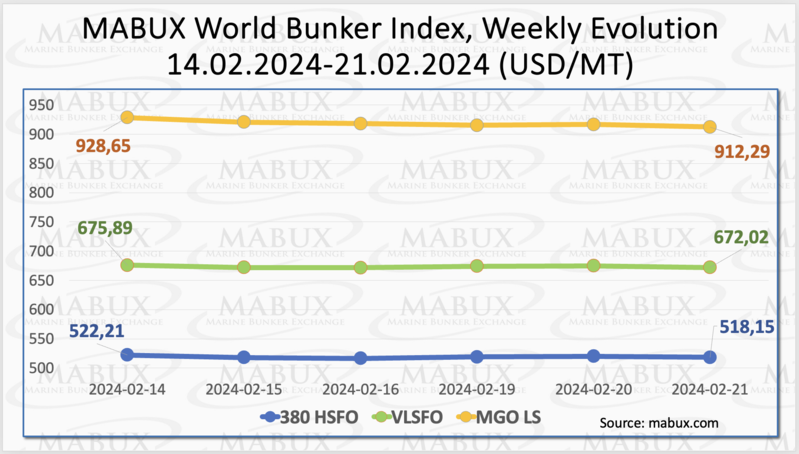

Over the 8th week, the MABUX global bunker indices experienced a moderate decline. The 380 HSFO index dropped by 4.06 USD: from 522.21 USD/MT last week to 518.15 USD/MT, approaching the 500 USD mark. Similarly, the VLSFO index, in turn, decreased by 3.87 USD (672.02 USD/MT versus 675.89 USD/MT last week). The MGO index lost 16.36 USD (from 928.65 USD/MT last week to 912.29 USD/MT). At the time of writing, the market has shown a moderate upward correction.

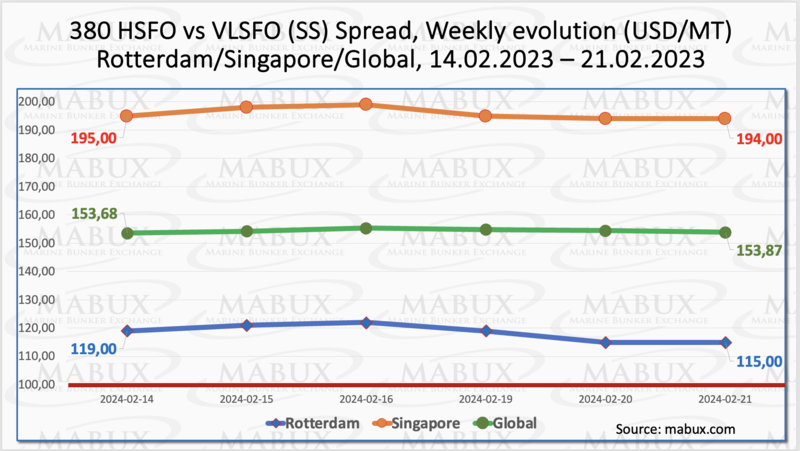

The Global Scrubber Spread (SS) - the price difference between 380 HSFO and VLSFO – slightly increased by $0.19 ($153.87 versus $153.68 last week). The weekly average increased by $1.04. Rotterdam witnessed a slight decrease in SS Spread, reaching minus $4.00 (from $119.00 to 115.00), approaching the $100 mark (SS breakeven), and the weekly average dropped by $1.33.In Singapore, the price difference for 380 HSFO/VLSFO narrowed by $1 ($194.00 vs. $195.00 last week), still hovering around the $200 mark. The weekly average, on the contrary, increased by $11.33. Thus, the dynamics of SS Spread show no clear trend yet. More information is available in the “Differentials” section of www.mabux.com.

Shell projects that global LNG demand will surge by over 50% by 2040, driven by the shift from coal to gas in the power generation and industrial sectors of China and South Asian countries. According to Shell's LNG Outlook 2024, worldwide LNG trade reached 404 million tonnes in 2023, a slight increase from 397 million tonnes in 2022. The growth is constrained by tight LNG supplies, sustaining prices and volatility above historical averages. Despite some regions experiencing peak LNG demand, Shell predicts a continuous global rise, reaching approximately 625-685 million tonnes per year by 2040. China is anticipated to lead LNG demand growth in the current decade, driven by efforts to reduce carbon emissions through the transition from coal to gas. Shell also highlights that despite a well-supplied global market in 2023, the absence of Russian pipeline gas supply to Europe and limited growth in LNG supply over the past year have left the global gas market structurally tight.

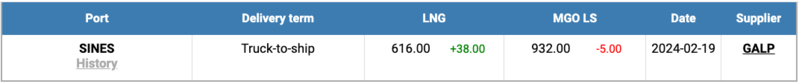

The price of LNG as bunker fuel in the port of Sines (Portugal) continued its upward trend, reaching 616 USD/MT on February 19 (plus 38 USD compared to the previous week). Concurrently, the difference in price between LNG and conventional fuel on January 19 decreased slightly, now standing at 316 USD in favor of LNG versus 391 USD a week earlier: MGO LS was quoted that day in the port of Sines at 932 USD/MT. More information is available in the LNG Bunkering section of www.mabux.com.

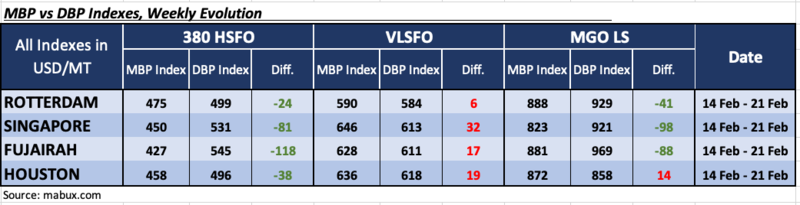

In week 08, the MDI index (the ratio of market bunker prices (MABUX MBP Index) vs. the MABUX digital bunker benchmark (MABUX DBP Index)) observed the following trends in four selected ports: Rotterdam, Singapore, Fujairah and Houston:

In the 380 HSFO segment, all four selected ports remained underpriced. Rotterdam's weekly average underpricing decreased by 28 points, while Singapore, Fujairah, and Houston saw increases of 9, 11, and 9 points, respectively. The MDI index in Fujairah remains above the $100 mark.

In the VLSFO segment, according to the MDI, Rotterdam has moved into the overcharge zone, where all four selected ports are thus currently located. The weekly average overprice premiums increased by 30 points in Rotterdam but fell by 9 points in Singapore, 9 points in Fujairah and 19 points in Houston.

Regarding the MGO LS segment, Houston remained the only overcharged port, with the average weekly ratio increasing by 6 points. The other three ports were undervalued, with average weekly underprice margins decreasing by 78 points in Rotterdam, 17 points in Singapore, and 11 points in Fujairah. Underprice levels in Rotterdam and Singapore fell below the $100 mark.

Thus, according to the MDI index, 380 HSFO and MGO LS remain undervalued in the world’s largest hubs, while overpricing is recorded in the VLSFO segment.

More information on the correlation between market prices and the MABUX digital benchmark is available in the “Digital Bunker Prices” section of www.mabux.com.

In January, Singapore witnessed the sale of approximately 4.85 million metric tonnes (mt) of conventional marine fuel, marking the second-highest monthly total ever recorded at the world's largest bunker port. Although slightly lower than the preceding monthly peak of 4.98 million mt achieved in December, the figures indicate a robust market. Notably, low sulphur fuel oil (VLSFO) dominated the sales, comprising over half of the total at 2.86 million mt. While year-on-year increases were observed in sales of high sulphur fuel oil (1.66 million mt) and marine gasoil (13,500 mt), both experienced a month-on-month decline. Among the fuel grades, VLSFO was the exclusive category to witness sales of bio-blended bunkers, with 45,300 mt of bio-blended VLSFO sold in Singapore last month. Additionally, liquefied natural gas (LNG) sales reached 10,400 mt during the month, while there were no registered sales of methanol. Looking back at 2023, it proved to be a record-breaking year for annual bunker sales in Singapore, with a total of 51.82 million mt of marine fuel sold. This surpassed the previous highest annual total of 50.64 million mt set in 2017, affirming Singapore's position as a global marine fuel hub.

In the absence of firm movers, we expect Global bunker indices to remain relatively stable next week.

By Sergey Ivanov, Director, MABUX

All news