The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

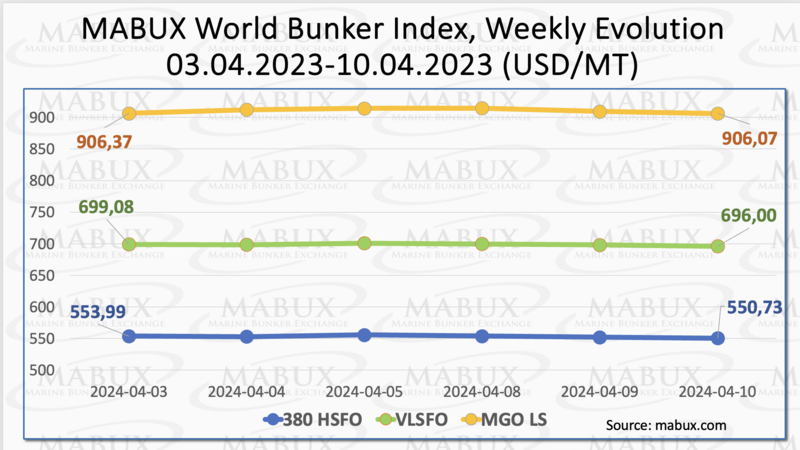

During Week 15, the MABUX global bunker indices experienced a marginal decline. The 380 HSFO index fell by 3.26 USD: from 553.99 USD/MT last week to 550.73 USD/MT. The VLSFO index decreased by 3.08 USD (696.00 USD/MT versus 699.08 USD/MT last week). The MGO index declined by a symbolic 0.30 USD (from 906.37 USD/MT last week to 906.07 USD/MT). At the time of writing, there was no clear trend in the global bunker market.

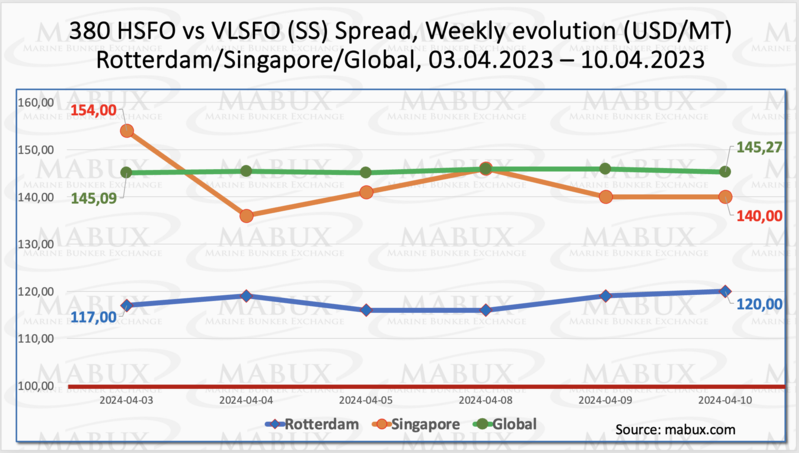

MABUX Global Scrubber Spread (SS) - the price difference between 380 HSFO and VLSFO - remained nearly static, edging up by a mere $0.18 to $145.27 from last week's $145.09. Meantime, the weekly average increased by $2.94. In Rotterdam, SS Spread expanded by $3.00 (from $117.00 last week to 120.00), consistently remaining above the $100.00 (SS Breakeven) threshold). The port's weekly average also added $5.83. Singapore witnessed a significant contraction in the 380 HSFO/VLSFO price difference, decreasing by $14.00 to $140.00 from last week's $154.00), breaking through the $150.00 mark, and the weekly average decreased by $9.00. We expect irregular changes in the SS Spread dynamics in the upcoming week. More information is available in the “Differentials” section of www.mabux.com.

Europe has successfully navigated this winter season with unprecedented levels of natural gas in storage, positioning itself strongly for the upcoming winter. As of the end of March, which marks the conclusion of the typical winter period, European natural gas reserves stand at 58.7% capacity - a new milestone. This surpasses the previous record of 56% set last winter. Europe is now gearing up to replenish its natural gas stocks. However, there are indications that Europe might opt for reduced LNG imports this summer to accommodate weaker demand and moderate the rate of stock accumulation, preventing premature site filling. According to some projections, Europe could reach 90% storage capacity by early August if it maintains the filling rate observed last year.

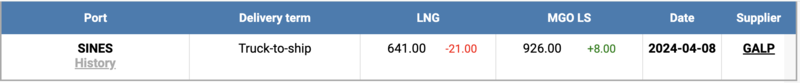

On April 08, the price of LNG as bunker fuel at the port of Sines, Portugal, dropped to 641 USD/MT, marking a decrease of 21 USD compared to the previous week. Concurrently, the price gap between LNG and conventional fuel widened on April 08, reaching 285 USD in favor of LNG, up from 263 USD the previous week. On that same day, MGO LS was priced at 926 USD/MT in the port of Sines. For further details, refer to the LNG Bunkering section on www.mabux.com.

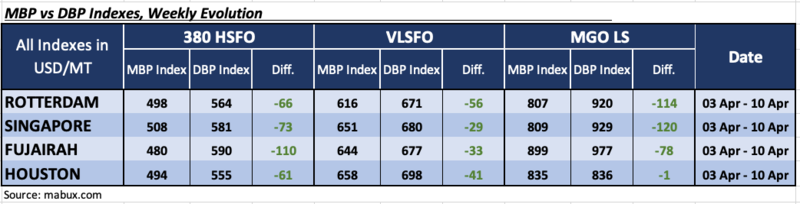

During Week 15, the MDI index (the ratio of market bunker prices (MABUX MBP Index) vs. the MABUX digital bunker benchmark (MABUX DBP Index)) registered undercharging across major bunker fuels in the world's top four hubs: Rotterdam, Singapore, Fujairah and Houston:

In the 380 HSFO segment, underprice weekly averages widened by 6 points in Rotterdam, 5 points in Singapore, 9 points in Fujairah, and 19 points in Houston. The MDI index in Fujairah remained above the $100 mark.

In the VLSFO segment, according to MDI, average weekly underpricing levels surged by 6 points in Rotterdam, 21 points in Singapore, 23 points in Fujairah, and 29 points in Houston.

In the MGO LS segment, Houston shifted to the undercharge zone, marking all four ports undervalued. Weekly average increased by 10 points in Rotterdam, 10 points in Singapore, 29 points in Fujairah, and 9 points in Houston. MDI indices in Rotterdam and Singapore continued to surpass the $100 threshold.

As Week 15 concluded, no overvalued ports were registered in any segments of the bunker market. The trend towards bunker fuel undervaluation is anticipated to persist next week.

More information on the correlation between market prices and the MABUX digital benchmark is available in the “Digital Bunker Prices” section of www.mabux.com.

BIMCO has reported that ship recycling for bulkers, tankers, and container ships has declined to its lowest level in 20 years over the past two years. This is attributed to robust demand following multiple market shocks and a low order book, which have extended the operational lifespan of older vessels. In the first quarter of 2024, only two million deadweight tonnes (DWT) of ship capacity were recycled, marking the ninth consecutive quarter with recycling levels below three million DWT. The last time recycling remained at such low levels for an extended period was prior to the 2008 financial crisis. Given that the current fleet is significantly larger than it was before the financial crisis, the past eight quarters have seen the lowest recycling rates in two decades. On average, only 0.1% of the fleet has been recycled during this period, compared to an average of 0.45% over the past 20 years. The recent Red Sea situation was identified as the latest in a series of shocks that have increased demand for shipping. Despite the current slowdown in recycling, BIMCO anticipates a rebound in ship recycling in the coming years. Ships that would have been retired and recycled if rerouting around the Cape of Good Hope had not been necessary are expected to be recycled once the Red Sea situation is resolved. Consequently, BIMCO projects that between 2023 and 2033, more than twice as many ships will be recycled compared to the past decade.

We expect the global bunker market to be dominated by irregular fluctuations with no clear trend in the coming week.

By Sergey Ivanov, Director, MABUX

All news