The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

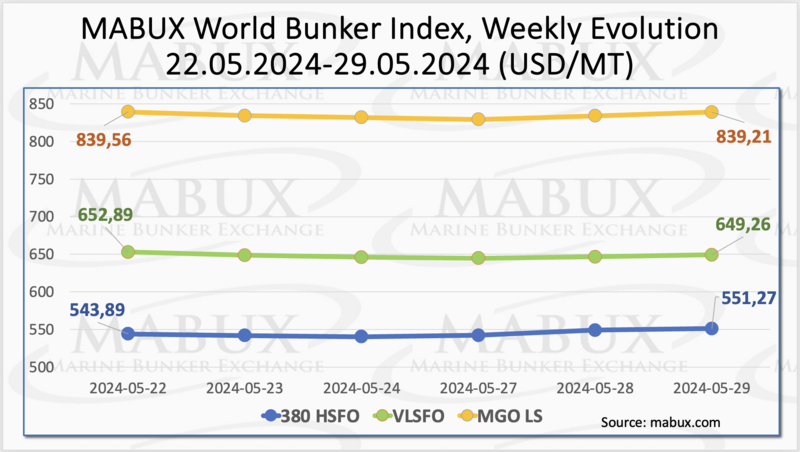

Over Week 22, the MABUX global bunker indices still did not have a clear trend and changed sideways. The 380 HSFO index rose by 7.38 USD: from 543.89 USD/MT last week to 551.27 USD/MT. The VLSFO index, on the contrary, decreased by 3.63 USD (649.26 USD/MT versus 652.89 USD/MT last week). The MGO index lost a symbolic 0.35 USD (from 839.56 USD/MT last week to 839.21 USD/MT). At the time of writing, a moderate upward trend continued in the global bunker market.

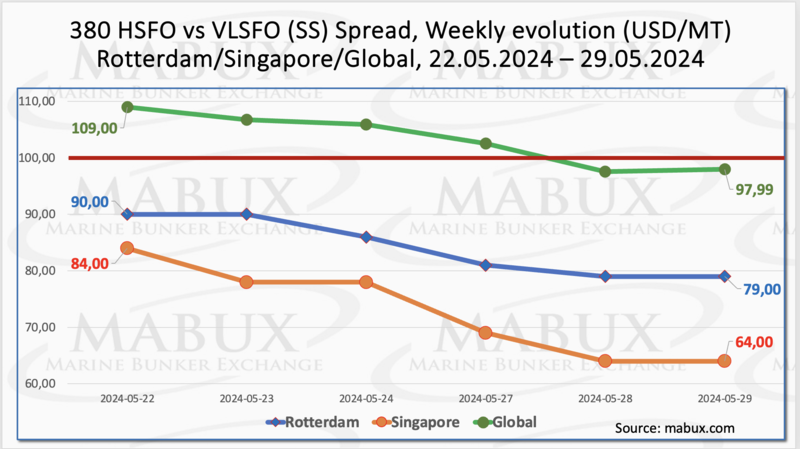

The MABUX Global Scrubber Spread (SS) - the price difference between 380 HSFO and VLSFO - saw a consistent decline: minus $11.01 ($110.14 versus $112.56 last week), dipping below the $100.00 SS breakeven point for the first time since October 10, 2023. The weekly average also fell by $9.21. In Rotterdam, the SS Spread decreased by $11.00 (from $90.00 last week to 79.00), staying well below the $100.00 mark. The port's weekly average dropped by $3.33. In Singapore, the 380 HSFO/VLSFO price differential showed the most significant reduction: minus $20.00 ($64.00 vs. $84.00 last week), with the weekly average decreasing by $23.00. Currently, the SS Spread is demonstrating a sustainable downward trend. Stable SS Spreads below the $100.00 mark adversely affect scrubber profitability and extend their payback period, while increasing demand for conventional and alternative bunker fuels. We anticipate the SS Spread to continue narrowing in the short term. More information is available in the “Differentials” section of www.mabux.com.

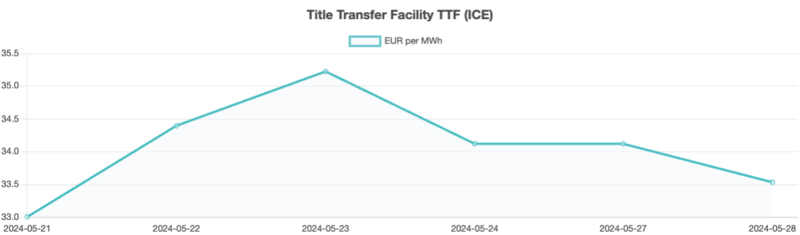

European benchmark natural gas prices rose last week due to growing supply concerns and forecasts of lower wind power generation. Unplanned outages in Norway, coupled with planned maintenance at some gas assets, higher natural gas demand in Asia, and the end of the current gas transit deal for Russian pipeline gas via Ukraine at the end of 2024, could further constrain gas supply for Europe and drive prices higher. During week 22, the European gas benchmark TTF continued its moderate growth, adding 0.530 EUR/MWh (33.534 EUR/MWh versus 33.004 EUR/MWh last week), while showing a decline over the last three trading days.

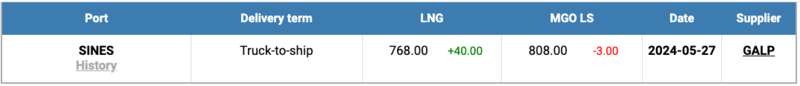

The price of LNG as bunker fuel in the port of Sines (Portugal) continued to rise, reaching 768 USD/MT on May 27 (plus 40 USD compared to last week). At the same time, the price difference between LNG and conventional fuel on May 27, on the contrary, decreased, amounting to 40 USD in favor of LNG (versus 89 USD a week earlier): MGO LS was quoted at 808 USD/MT that day in the port of Sines. More information is available in the LNG Bunkering section of www.mabux.com.

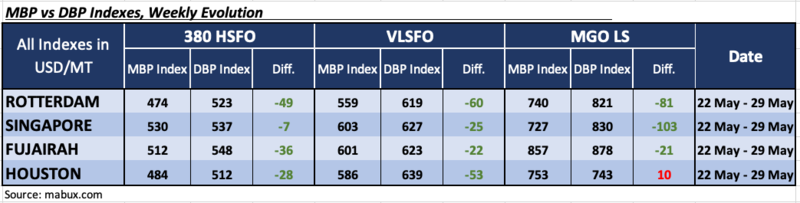

In Week 22, the MDI index (the correlation ratio of market bunker prices (MABUX MBP Index) vs. MABUX digital bunker benchmark (MABUX DBP Index)) observed the following trends across the major world hubs: Rotterdam, Singapore, Fujairah and Houston:

In the 380 HSFO segment, all selected ports remained undervalued. Weekly averages rose 6 points in Rotterdam, 15 points in Singapore, 18 points in Fujairah, and 6 points in Houston.

In the VLSFO segment, according to the MDI, all ports were undervalued, with average weekly levels showing an increase of 4 points in Singapore and 3 points in Houston, and a decrease of 2 points in Rotterdam and 1 point in Fujairah. The MDI index in Fujairah remained close to 100 percent correlation between the market price and the MABUX digital benchmark.

In the MGO LS segment, Houston remained the only overvalued port, with its weekly average rising 7 points and the MDI index consistently above the 100 percent correlation mark between market price and the MABUX digital benchmark. All other ports were undervalued. Average weekly levels showed a further 3-point decline in Rotterdam and 1-point in Singapore, but a 13-point increase in Fujairah. The MDI index in Singapore stayed above $100.

By the end of the week, the balance of overvalued/undervalued ports, as well as the trend towards undervaluation of bunker fuel, did not undergo significant changes across all market segments.

For more details on the correlation between market prices and the MABUX digital benchmark, visit the “Digital Bunker Prices” section on www.mabux.com.

According to DNV, the gap between LNG-fueled tonnage and the necessary infrastructure for fueling them is widening. Despite this, industry stakeholders are still waiting for market assurances before investing in LNG bunker vessels. There is a clear shortage of these vessels, and the class society expects this shortage to become apparent in roughly 12 months. DNV estimates that 2.3 million tonnes of LNG were bunkered in 2023, which accounts for 1% of the global marine fuels market. This market is growing rapidly, with LNG consumption expected to increase by 400%, reaching 11 million tonnes by 2026.

We expect that the downward trend in the global bunker market has reached its limit, and next week the growth of bunker prices will become sustainable.

By Sergey Ivanov, Director, MABUX

All news