The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

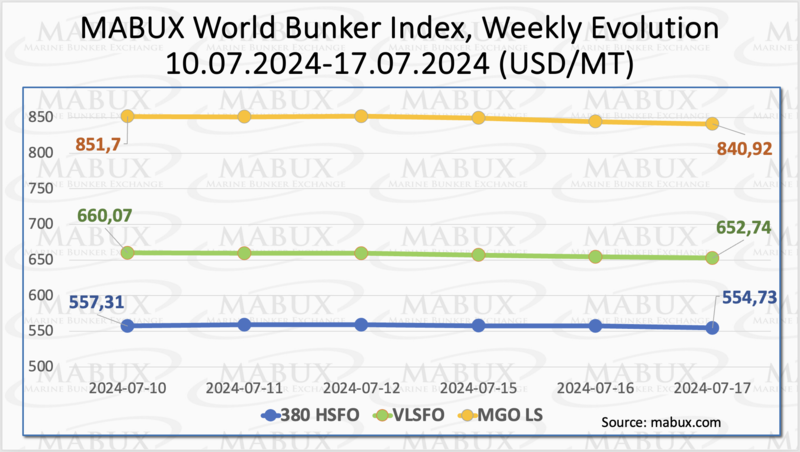

Over Week 29, the MABUX global bunker indices continued moderate downward movement. The 380 HSFO index fell by 2.58 USD, from 557.31 USD/MT last week to 554.73 USD/MT, remaining in the range of 550-560 USD. The VLSFO index decreased by 7.33 USD (652.74 USD/MT versus 660.07 USD/MT last week). The MGO index fell by 10.78 USD (from 851.70 USD/MT last week to 840.92 USD/MT). At the time of writing, global bunker indices continued to decline slightly.

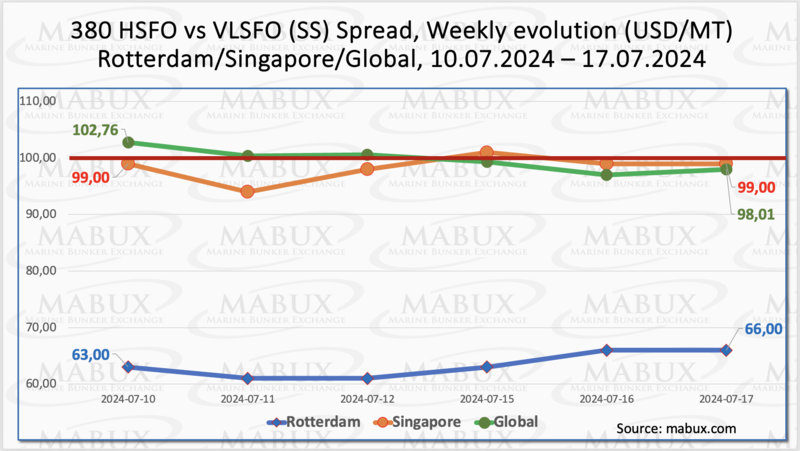

MABUX Global Scrubber Spread (SS) - the price difference between 380 HSFO and VLSFO - showed a moderate decline: minus $4.75 ($98.01 versus $102.76 last week), falling again below $100.00 (SS Breakeven). The weekly average also decreased by $3.15. In Rotterdam, the SS Spread increased by $3.00 to $66.00 from $63.00 last week, though the weekly average at the port dropped by $2.50. In Singapore, the 380 HSFO/VLSFO price differential remained unchanged at $99.00, steadily below the $100.00 mark. The port's weekly average showed a decrease of $8.00. Currently, both the Global SS Spread and the index values in the ports are stably below the critical mark of $100. We expect the SS Spread to remain relatively unchanged next week. More information is available in the “Differentials” section of www.mabux.com.

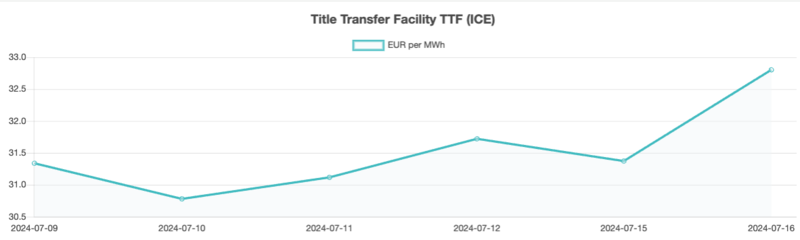

In Europe, TTF prices are stable despite weak demand and high storage levels. Besides, lower LNG inflows, unplanned outages, and geopolitical uncertainties have all supported higher gas prices in the EU. Alongside lower carbon prices, gas-fired power generation now appears less competitive than the most efficient coal-fired power plants. During week 29, the European gas benchmark TTF showed a moderate growth: plus 1.462 EUR/MWh (32.797 EUR/MWh versus 31.335 EUR/MWh last week).

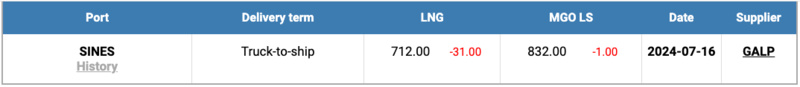

The price of LNG as bunker fuel in the port of Sines (Portugal) continued to decline, reaching a level of 712 USD/MT on July 16 (minus 31 USD compared to last week). At the same time, the difference in price between LNG and conventional fuel on July 16 increased to 120 USD in favor of LNG, up from 113 USD a week earlier: MGO LS was quoted that day at 832 USD/MT in the port of Sines. More information is available in the LNG Bunkering section of www.mabux.com.

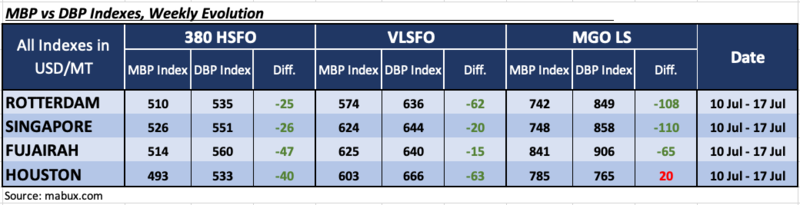

In Week 29, the MDI index (the correlation ratio of market bunker prices (MABUX MBP Index) vs. MABUX digital bunker benchmark (MABUX DBP Index) recorded the following bunker price trends in the world's four largest hubs: Rotterdam, Singapore, Fujairah and Houston:

In the 380 HSFO segment, all four ports were in the undercharge zone, with weekly averages down 4 points in Rotterdam, 5 points in Singapore, 3 points in Fujairah, and 4 points in Houston.

In the VLSFO segment, all four ports were undervalued, with average weekly levels showing a 3-point decline in Rotterdam and Fujairah. The MDI index in Singapore and Houston remained unchanged.

In the MGO LS segment, Houston returned to the overcharge zone, making it the only overvalued port. The weekly overprice average widened by 21 points. The other three ports remained undervalued, with weekly averages increasing by 7 points in Rotterdam but decreasing by 7 points in Singapore and 16 points in Fujairah. MDI indices in Rotterdam and Singapore stayed consistently above the $100 mark.

As a result of the week, there was one overvalued port – Houston – registered in the MGO LS segment – Houston, while in the other three ports, all types of bunker fuel remained undervalued. We expect that the overpricing in Houston is temporary and the trend towards underestimation of all fuel types will be observed again next week in all selected ports.

For more details on the correlation between market prices and the MABUX digital benchmark, visit the “Digital Bunker Prices” section on www.mabux.com.

The ICC’s International Maritime Bureau (IMB) has reported 60 incidents of piracy and armed robbery against ships in the first half of 2024, compared to 65 incidents during the same period in 2023. Of these 60 incidents, 46 vessels were boarded, eight reported attempted attacks, four were hijacked, and two were fired upon. Perpetrators successfully boarded 84% of targeted vessels. There has been a noticeable increase in violence, with 85 hostages taken compared to 36 in the same period last year. Guns and knives were reported in 34 of the 60 incidents, which the IMB described as ‘a worrying increase’ from last year. The IMB commented: ‘While the decline in reported incidents is welcome, sustained and continued regional maritime cooperation remains essential to safeguard seafarers, global shipping, and trade. There is no room for complacency.’

We foresee next week the downward trend in the global bunker market will exhaust its potential, and bunker indices will return to moderate growth.

By Sergey Ivanov, Director, MABUX

All news