The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

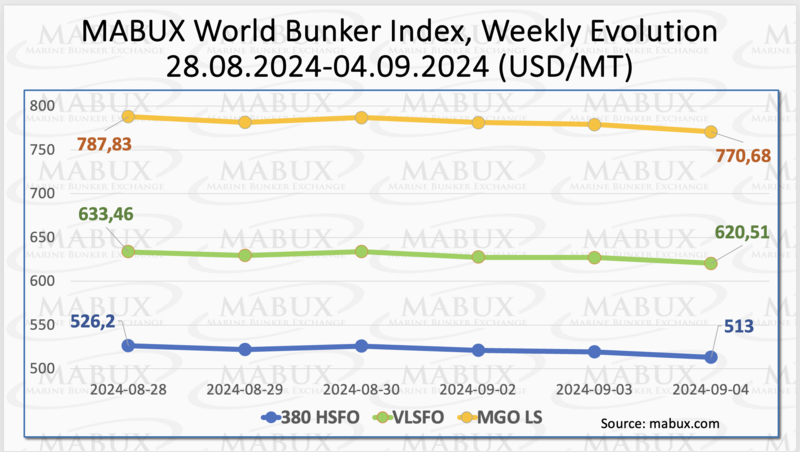

Over the Week 36, the MABUX global bunker indices experienced a consistent downward trend. The 380 HSFO index fell by USD 13.20: from USD 526.20/MT last week to USD 513.00/MT, nearing the USD 500 threshold. Similarly, the VLSFO index dropped by USD 12.95 (USD 620.51/MT versus USD 633.46/MT last week). The MGO index saw a decline of USD 17.15 (from USD 787.83/MT last week to USD 770.68/MT). At the time of writing, global bunker indices continued their moderate decline.

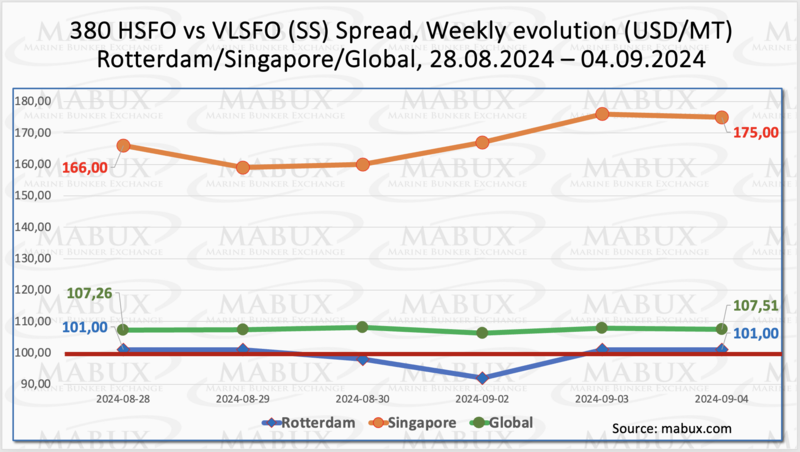

MABUX Global Scrubber Spread (SS) - the difference in price between 380 HSFO and VLSFO – remained nearly unchanged, strengthening slightly to $107.51, an increase of $0.25 from the previous week. At the same time, the index weekly average increased by $4.98. In Rotterdam, the SS Spread value remained steady at $101.00. The weekly average in the port increased by $10.00. In Singapore, the spread between 380 HSFO and VLSFO continued to grow - plus $9.00: from $166.00 last week to $175.00, and the weekly average in the port added $ 14.34. Currently, the Global SS Spread, along with index readings at major ports, remains above the SS Breakeven mark of $100.00, which suggests a return to profitability for the 380 HSFO + scrubber combination in the global bunker market. We expect the upward momentum of the SS Spread to persist into next week. Further details can be found in the Differentials section on www.mabux.com.

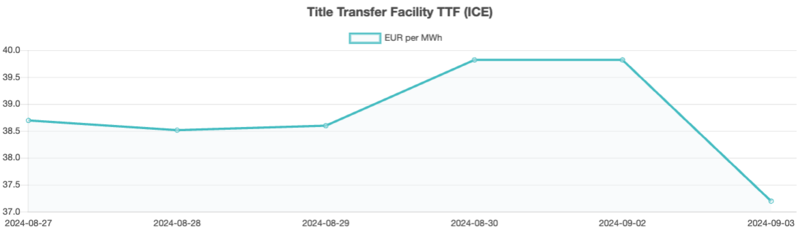

The global natural gas market is currently experiencing mixed dynamics. The European segment appears more optimistic, while the US market continues to lag behind. European natural gas futures have held steady at around €40 per megawatt-hour, supported by supply constraints linked to annual maintenance in Norway and ongoing geopolitical tensions. The maintenance work has cut Norwegian gas supplies by 10 million cubic meters per day, impacting key pipelines such as Franpipe, Emden, and Dornum. Despite these challenges, European regional storage facilities remain robust, with levels at 92,52% full as of September 03. Meantime, by the end of Week 36, the European gas benchmark TTF decreased by 1.496 EUR/MWh (37.193 EUR/MWh versus 38.689 EUR/MWh last week).

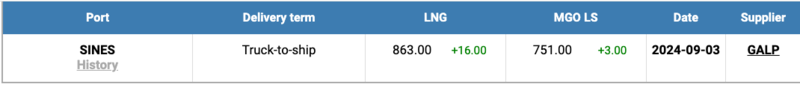

By September 03, the price of LNG as bunker fuel in the port of Sines, Portugal, had increased by $16 compared to the previous week, reaching $863 per MT. Meanwhile, the price gap between LNG and conventional fuel (MGO LS) widened to $112, compared to $76 the week before. On the same day, MGO LS was quoted at $751 per MT in the port of Sines. More detailed information is available in the LNG Bunkering section on www.mabux.com.

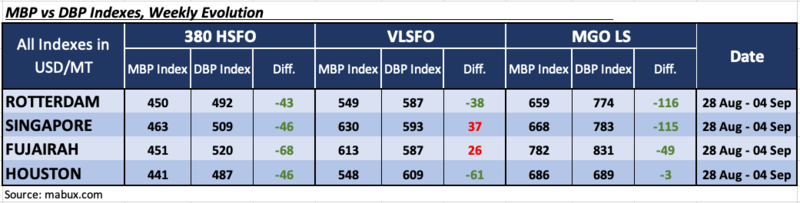

In Week 36, the MDI index (the correlation ratio of market bunker prices (MABUX MBP Index) vs. MABUX digital bunker benchmark (MABUX DBP Index)) registered the following trends across the four largest global hubs: Rotterdam, Singapore, Fujairah and Houston:

• 380 HSFO segment: All four ports remained undervalued, with weekly averages rising by 2 points in Rotterdam, 6 points in Singapore, 2 points in Fujairah, and 1 point in Houston.

• VLSFO segment: Two ports, Singapore and Fujairah, were in the overvalued zone, with weekly averages rising by 11 points in Singapore and 10 points in Fujairah. Rotterdam and Houston remained undervalued. The weekly average fell by 9 points in Rotterdam. The Houston’s MDI was unchanged.

• MGO LS segment: Fuel remained undervalued in all four ports. Weekly averages fell by 10 points in Rotterdam and 7 points in Fujairah but rose by 5 points in Singapore and 1 point in Houston. The Rotterdam and Singapore MDIs remained stable above the $100 mark, while the Houston MDI neared the 100% correlation mark between the market price and the MABUX digital bunker benchmark.

By the end of the week, the balance of overvalued/undervalued ports remained unchanged, showing mixed dynamics likely to continue into next week.

For more details on the correlation between market prices and the MABUX digital benchmark, visit the “Digital Bunker Prices” section on www.mabux.com.

A recent study by Mærsk raises significant concerns about the availability of renewable fuels, particularly biodiesel, to meet the decarbonization requirements set by FuelEU. The study indicates that the current maritime fuel mix, which includes liquefied natural gas (LNG) and biodiesel, has the potential to achieve up to 90% of the required emissions reductions. However, the availability of biodiesel, which is often blended with conventional fuel oil, poses a major challenge. Biodiesel is considered a cost-effective short-term solution for compliance with FuelEU regulations. Yet, the report highlights increasing uncertainty about the future supply of biodiesel, primarily due to the limited availability of feedstocks like used cooking oil, which are crucial for producing certified sustainable biodiesel. Industry experts warn that EU ports may face difficulties in securing the estimated 600,000 tonnes of biodiesel needed by 2025. This challenge is further complicated by the competition for these feedstocks from other sectors, such as aviation and heavy-duty transportation, which also require them to meet their decarbonization goals. As a result, the supply of biodiesel is likely to be strained, leading to higher prices. This could make it difficult for shipping companies to meet FuelEU targets without incurring significant cost increases.

We anticipate that the global bunker market will continue its moderate downward trend into next week.

By Sergey Ivanov, Director, MABUX