The Bunker Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

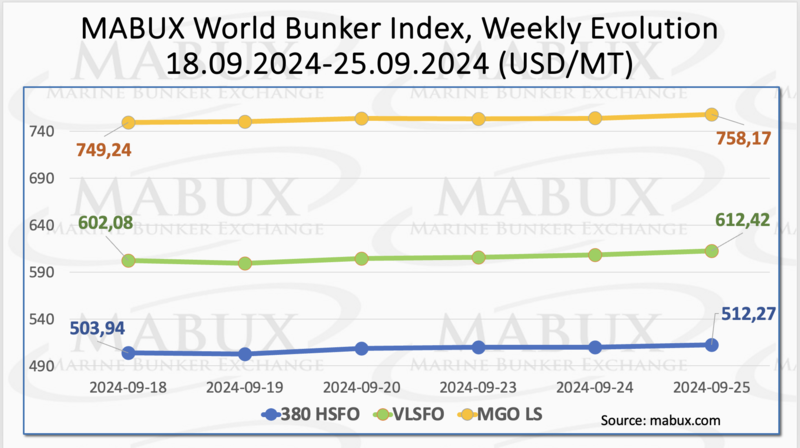

During the Week 39, the MABUX global bunker indices experienced moderate growth. The 380 HSFO index rose by USD 8.33: from USD 503.94/MT last week to USD 512.27/MT, staying close to the USD 500 mark. The VLSFO index increased by USD 10.34 (USD 612.42/MT versus USD 602.08/MT last week). The MGO index added USD 8.93 (from USD 749.24/MT last week to USD 758.17/MT). At the time of writing, there were no significant shifts in the global bunker market indices.

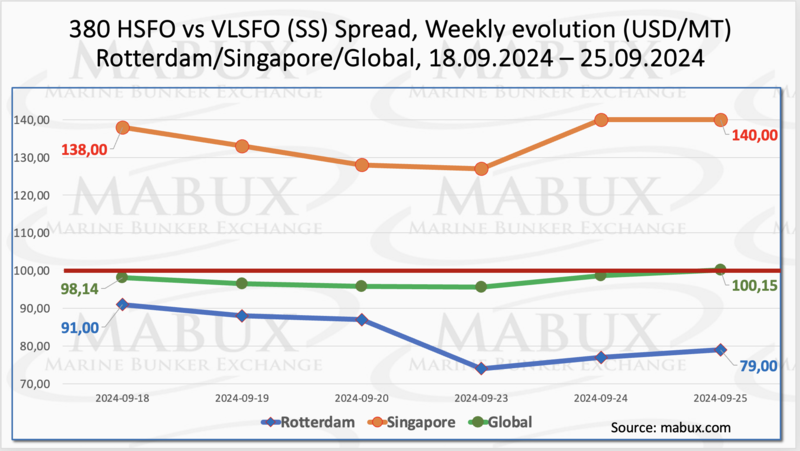

The MABUX Global Scrubber Spread (SS) - the price difference between 380 HSFO and VLSFO - increased moderately by $2.01 (from $98.14 last week to $100.15), touching the $100.00 SS Breakeven point. However, the weekly average decreased by $1.64. In Rotterdam, SS Spread dropped by $12.00, remaining steadily below the $100.00 mark at $79.00 (compared to $91.00 the previous week). The weekly average value in the port also decreased by $14.33. In Singapore, the 380 HSFO/VLSFO price spread grew by $2.00: from $138.00 last week to $140.00, while the weekly average in the port, on the contrary, decreased by $6.50. The SS Spread continues to show mixed movements, and this trend is expected to persist into next week. More information is available in the Differentials section of www.mabux.com.

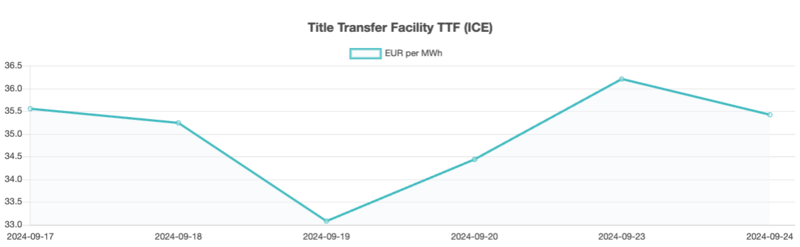

According to the Institute for Energy Economics and Financial Analysis (IEEFA), Europe may have already peaked in LNG demand, and much of its expanding LNG import infrastructure could become stranded assets by the end of the decade. LNG imports into Europe fell by 20% year-on-year in the first half of 2024. “Europe” includes the EU, the UK, Norway, and Turkey. Despite this decline in LNG imports, many European countries continue to plan investments in new LNG terminals. IEEFA predicts that this could result in over 300 billion cubic meters (bcm) of unused capacity in Europe by 2030, as demand is expected to fall below planned capacity. As of September 25, regional European storage facilities were 93.74% full. Meanwhile, the European TTF gas benchmark showed little change for Week 39, with a slight decline of EUR 0.134/MWh, closing at EUR 35.413/MWh (compared to EUR 35.547/MWh the previous week).

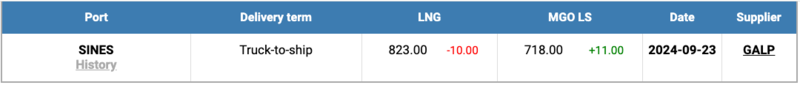

The price of LNG as bunker fuel in the port of Sines (Portugal) fell by another $10 this week compared to the previous week, reaching $823/MT on September 23. Meanwhile, the price gap between LNG and conventional fuel continued to narrow: on September 23, the difference was $105 in favor of MGO LS, down from $136 the previous week. MGO LS was quoted at $718/MT in the port of Sines on the same day. More detailed information is available in the LNG Bunkering section on www.mabux.com.

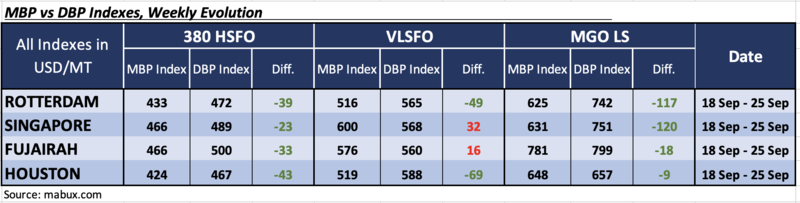

For Week 39, the MDI index (the correlation ratio of market bunker prices (MABUX MBP Index) vs. MABUX digital bunker benchmark (MABUX DBP Index)) indicated the following trends across the four largest global hubs: Rotterdam, Singapore, Fujairah and Houston:

• 380 HSFO segment: All four ports were undervalued. Weekly averages fell by 9 bps in Rotterdam and by 7 bps in Singapore, but rose by 12 bps in Fujairah. The MDI index in Houston remained unchanged.

• VLSFO segment: Singapore and Fujairah continued to be overvalued, with weekly averages falling by 5 bps in Singapore and 19 bps in Fujairah. Rotterdam and Houston remained undervalued. Weekly averages rose by 9 bps in Rotterdam and 3 bps in Houston.

• MGO LS segment: All four selected ports were in the overvalued zone. Weekly averages showed increases of 8 points in Rotterdam, 9 points in Singapore, 14 points in Fujairah, and 9 points in Houston. The MDI indices in Rotterdam and Singapore remained stable above the $100 mark, while Houston's index stayed close to the 100% correlation mark between market prices and the MABUX digital benchmark.

By the end of the week, there were no significant changes in the balance between overvalued/undervalued ports. The global bunker market continues to trend toward the undervaluation of all types of bunker fuel.

For more insights on the correlation between market prices and the MABUX digital benchmark, visit the “Digital Bunker Prices” section at www.mabux.com.

The Port of Rotterdam reported that 25 partners involved in the Rotterdam-Singapore Green & Digital Shipping Corridor discussed the project's progress and agreed that demand for sustainable bunker fuels along the corridor could exceed 5 million tonnes per year by 2028. However, they noted that the availability and accessibility of such fuels still require significant improvement. The project aims to cut emissions from large container ships traveling the 15,000-kilometre route by at least 20% by 2030, through the adoption of low- and zero-carbon marine fuels. Currently, bio- and synthetic (e-) variants of methanol and methane are prioritized, with ammonia and hydrogen expected to follow in the coming years. Despite sustainable fuels being two to three times more expensive than fossil fuels, the Port of Rotterdam emphasized the efforts of international organizations like the European Union and the International Maritime Organization (IMO) in promoting sustainable fuel production. It also noted its collaboration with the Maritime and Port Authority of Singapore (MPA) to develop operational bunkering frameworks for these new fuels.

We expect the global bunker market to retain its growth potential, with bunker indices showing a moderate upward trend next week.

By Sergey Ivanov, Director, MABUX

All news