The Bunker Outlook was contributed by Marine Bunker Exchange (MABUX)

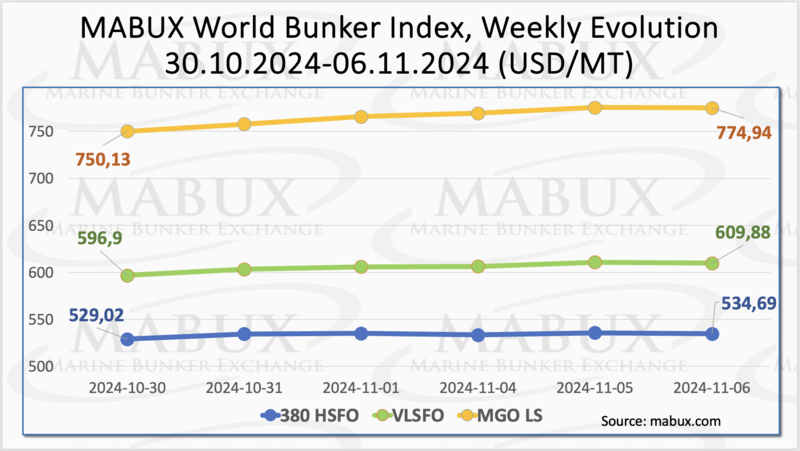

Over the Week 45, the MABUX global bunker indices moved upward. The 380 HSFO index rose by 5.67 USD: from 529.02 USD/MT last week to 534.69 USD/MT. The VLSFO index increased by 12.98 USD (609.08 USD/MT versus 596.90 USD/MT last week), surpassing the $600 mark again. The MGO index added 24.81 USD (from 750.13 USD/MT last week to 774.94 USD/MT). At the time of writing, the global bunker indices shifted to a moderate downward correction.

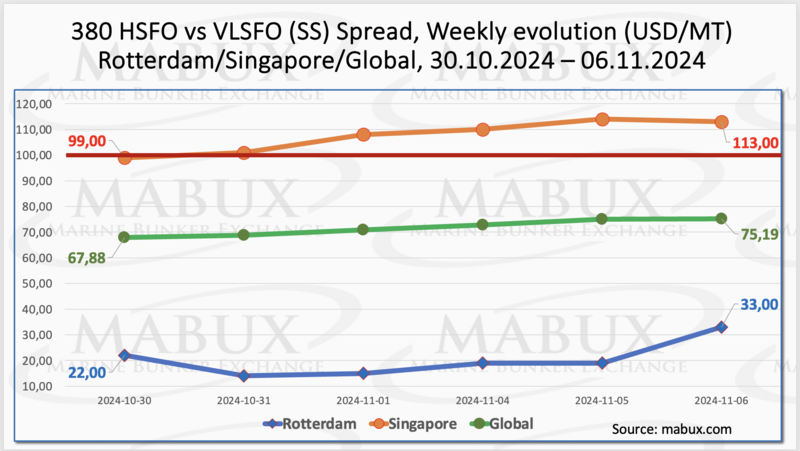

MABUX Global Scrubber Spread (SS) - the price difference between 380 HSFO and VLSFO - registered moderate growth, rising by $7.31 (from $67.88 last week to $75.19). Despite this increase, the SS remains well below the $100 mark (SS Breakeven). The weekly average for the index fell slightly by $0.44. In Rotterdam, the SS Spread widened by $11.00 ($33.00 versus $22.00 last week), though it hit a record low of $10.00 during the week. The weekly average at the port dropped by $13.34. In Singapore, the 380 HSFO/VLSFO spread rose by $14.00, from $99.00 to $113.00, again surpassing the $100.00 mark. The weekly average in Singapore increased by $4.50. Overall, the SS Spread segment indicates a potential for further widening, though values remain below or near the $100.00 threshold, reflecting continued low profitability for the 380 HSFO + scrubber combination. We anticipate a moderate increase in the price differential between 380 HSFO and VLSFO next week. More information is available in the Differentials section of mabux.com.

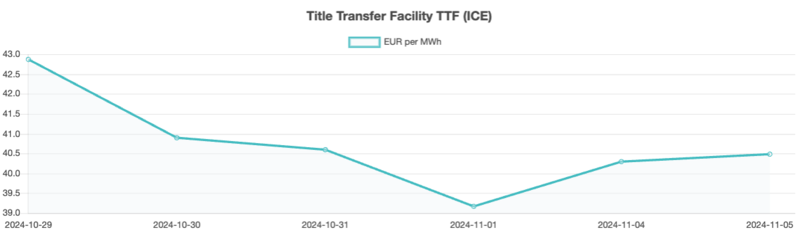

Gas prices in Europe have unexpectedly risen as markets remain cautious amid recent supply disruptions from Norway and the U.S. According to Standard Chartered, the recent trend has been to withdraw gas on weekdays and replenish stocks on weekends. This pattern may indicate that the seasonal peak in gas stocks is either close to being reached or has already passed. As of November 4, European regional storage facilities were 95.33% full. The European gas benchmark TTF closed the week with a decline of 2.377 euros/MWh, settling at 40.492 euros/MWh, down from 42.869 euros/MWh the previous week).

The price of LNG as a bunker fuel at the Port of Sines, Portugal, dropped sharply by USD 100 over the week, reaching USD 848/MT on November 5. Meanwhile, the price gap between LNG and conventional fuel has narrowed significantly. As of November 5, MGO LS was USD 105 cheaper than LNG, compared to a USD 229 difference a week earlier, with MGO LS priced at USD 743/MT in Sines. More details can be found in the LNG Bunkering section on mabux.com.

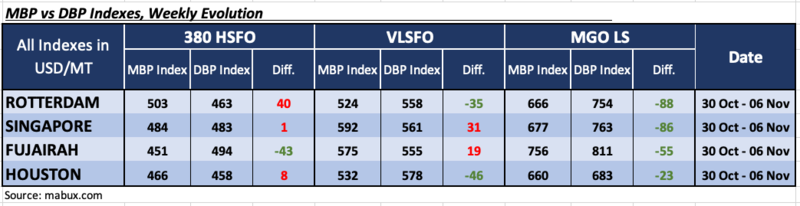

During Week 45, the MDI index (the correlation ratio of market bunker prices (MABUX MBP Index) vs. MABUX digital bunker benchmark (MABUX DBP Index)) registered the following trends across the four largest global hubs: Rotterdam, Singapore, Fujairah and Houston:

• 380 HSFO segment: Three ports at once: Rotterdam, Singapore and Houston were in the overvalued zone. The weekly averages increased by 3 points in Rotterdam, but decreased by 1 point in Houston. The MDI index in Singapore held steady, still hovering near the 100% correlation mark between the market price and the MABUX digital benchmark. Fujairah remained the only undervalued port, with no change in its index.

• VLSFO segment: Singapore and Fujairah stayed in the overvalued zone, with the weekly average increasing by 5 points in Singapore and 4 points in Fujairah. Rotterdam and Houston remained undervalued; Rotterdam’s average rose by 10 points, while Fujairah’s decreased by 5 points.

• MGO LS segment: All four selected ports were undercharged. with Fujairah’s average rising by 4 points while Singapore’s fell by 8 points. The MDI indices in Rotterdam and Houston remained unchanged. The MDI values for all ports were well below the $100.00 mark.

Overall, the overvalued/undervalued port balance remained stable. Overvalued ports continued to dominate the 380 HSFO segment, while undervalued ports led in the MGO LS segment. No significant changes are anticipated next week. More insights can be found in the “Digital Bunker Prices” section at mabux.com.

The European Community Shipowners' Associations (ECSA) and the NGO Transport & Environment (T&E) have urged EU leaders to make shipping a key component of the upcoming Clean Industrial Deal. They advocate for at least 40% of the clean fuels and innovative technologies required to achieve the EU’s climate goals for shipping to be produced within Europe. A recent report by Mario Draghi indicates that the transition of the shipping industry to sustainable energy will demand an annual investment of €40 billion from 2031 to 2050. ECSA and T&E emphasize that building a European supply chain for clean fuels is essential to enable the shipping sector to meet its decarbonization goals and to support Europe’s broader climate objectives. The two organizations have presented a “wish list” for EU action, highlighting the need to position shipping, clean fuel production, and technological innovation as critical to Europe’s green energy transition. Their recommendations include accelerating the shift of European shipping to clean fuels, using funds from the European Union Emissions Trading System (ETS) to support maritime decarbonization via EU and national investment plans, and securing both public and private financing. Additionally, they call for guaranteed access to clean energy for shipping through mandatory fuel supply requirements for producers and suppliers at European ports.

We expect the upward trend across all bunker fuel segments to persist into next week.

By Sergey Ivanov, Director, MABUX

All news