The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

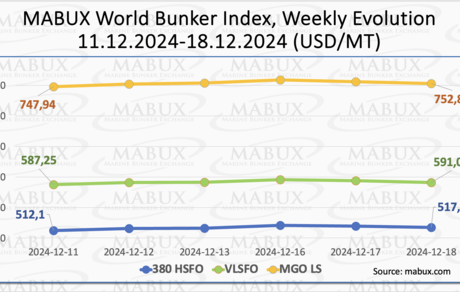

Over the 51st week, the MABUX global bunker indices experienced moderate growth. The 380 HSFO index increased by USD 5.22: climbing from USD 512.10/MT last week to USD 517.32/MT, remaining above the USD 500 mark. The VLSFO index increased by USD 3.80, reaching USD 591.05/MT compared to USD 587.25/MT last week, edging closer to the USD 600 threshold. Meanwhile, the MGO index gained USD 4.92, rising from USD 747.94/MT last week to USD 752.86/MT. At the time of writing, the global bunker market continued its upward trend.

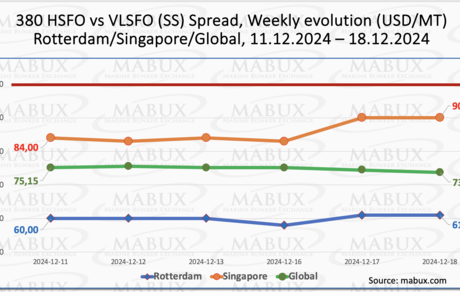

MABUX Global Scrubber Spread (SS) - the price difference between 380 HSFO and VLSFO – decreased slightly by$1.42 falling from $75.15 last week to $73.73. It remains confidently below the $100.00 breakeven mark. The index's weekly average also saw a minor drop of $0.17. In Rotterdam, the SS Spread widened slightly, increasing by $1.00 from $60.00 to $61.00. The port's weekly average rose more significantly, gaining $11.33. Meanwhile, in Singapore, the 380 HSFO/VLSFO price difference increased by $6.00, climbing from $84.00 to $90.00 and nearing the $100.00 mark. However, Singapore's weekly average declined by $5.33. Overall, the Global SS Spread, and regional indices showed no clear trend during the week but remained below the $100.00 threshold. We anticipate that the SS Spread dynamics will not see significant changes next week, continuing to fluctuate in varying directions. More detailed information is available in the "Differentials" section of mabux.com.

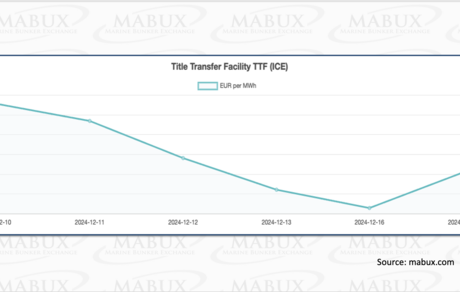

Although natural gas prices have eased slightly, an upward trend is expected to resume in the early months of the new year as seasonal demand peaks in the northern hemisphere. Europe is set to remain the primary driver of natural gas consumption during this period. In Germany, coal continues to dominate as the leading energy source, followed by natural gas and wind, while solar power lags behind expectations. Meanwhile, Germany, France, Italy, and the Netherlands are all reporting gas withdrawals outpacing new injections into storage facilities.

As of December 16, European regional storage facilities were 77.49% full, down 4.05% compared to the previous week, with withdrawals ongoing. By the end of the 51st week, the European gas benchmark, TTF, showed a moderate decline of 3.487 euros/MWh, settling at 42.065 euros/MWh compared to 45.552 euros/MWh the previous week).

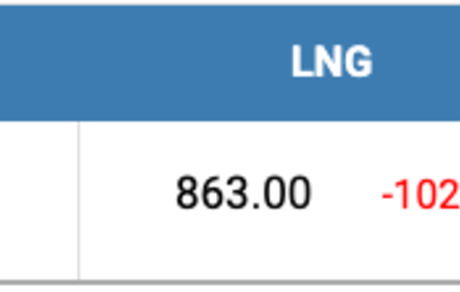

The price of LNG as a bunker fuel at the port of Sines (Portugal) fell by USD 102 over the week, reaching USD 863/MT on December 16. Meanwhile, the price gap between LNG and conventional fuel also narrowed significantly on the same date: MGO LS was priced at USD 731/MT, resulting in a difference of USD 132 in favor of MGO LS, compared to USD 248 the previous week. For more details, visit the LNG Bunkering section on mabux.com.

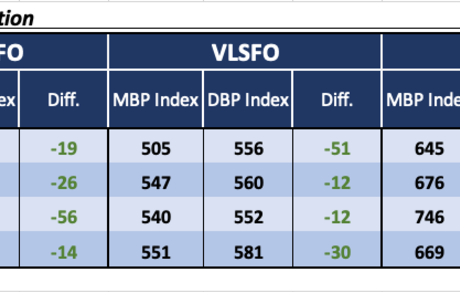

During Week 51, the MABUX Market Differential Index (MDI) (the correlation between market bunker prices (MBP) and the MABUX digital bunker benchmark (DBP)) remained in the undervalued zone for all types of bunker fuel in major hubs: Rotterdam, Singapore, Fujairah and Houston:

• 380 HSFO segment: Weekly average undervaluation increased by another 15 points in Rotterdam, 6 points in Singapore, 7 points in Fujairah, and 4 points in Houston.

• VLSFO segment: Weekly underpricing widened by 3 points in Rotterdam, 9 points in Singapore, 6 points in Fujairah, and 2 points in Houston.

• MGO LS segment: Weekly average undercharge rose by 16 points in Rotterdam, 1 point in Singapore, 12 points in Fujairah, and 9 points in Houston. The MDI in Singapore is approaching the $100 mark, while Rotterdam remains above it.

The balance between overvalued and undervalued ports did not shift during the week. Undervaluation of bunker fuel continues to dominate across all ports, and this trend is expected to persist into the following week.

Further insights on the correlation between market prices and the MABUX digital benchmark are available in the Digital Bunker Prices section of mabux.com.

Ship voyage emissions could be cut by up to 25% through optimized port arrivals that account for congestion and waiting times, presenting a “critical opportunity” to reduce greenhouse gas (GHG) emissions, according to research by the UCL Energy Institute and maritime consultancy UMAS. The study found potential average emissions savings of approximately 10% for container ships and bulk carriers, 16% for gas and oil tankers, and nearly 25% for chemical tankers. These reductions are based on the potential for ships to lower voyage speeds by timing arrivals to coincide with berth availability. The analysis, which examined ship movements from 2018 to 2022, revealed that vessels spent 4–6% of their operational time waiting at ports—equivalent to 15–22 days per year—with average waiting times continuing to rise. The study's authors recommend that the IMO's Carbon Intensity Indicator (CII) regulation consider all aspects of a voyage, not just the "sea passage.

We believe that next week, the global bunker market will remain in a phase of establishing a stable trend, while bunker indices are expected to continue fluctuating irregularly.

By Sergey Ivanov, Director, MABUX