The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

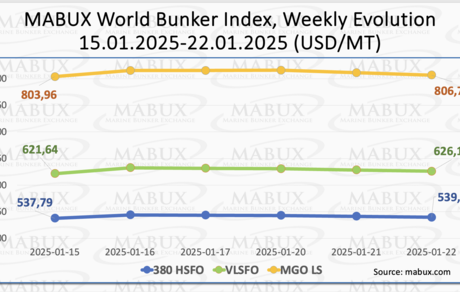

Over the 04th week, the MABUX global bunker indices continued a moderate upward movement. The 380 HSFO index increased by 1.92 USD, rising from 537.79 USD/MT to 539.71 USD/MT. Similarly, the VLSFO index climbed by 4.51 USD, reaching 626.15 USD/MT from last week's 621.64 USD/MT. The MGO index also saw a gain of 2.77 USD, moving from 803.96 USD/MT to 806.73 USD/MT. However, as of this writing, early indications of a downward trend in the global bunker market have been observed.

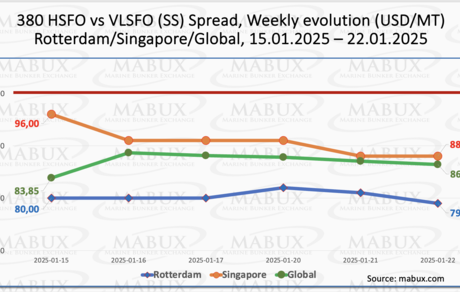

MABUX Global Scrubber Spread (SS) - the price between 380 HSFO and VLSFO – recorded a slight increase: plus $2.59 (from $83.85 last week to $86.44), but still remained below the $100.00 breakeven mark. The weekly average of the index grew by $3.67. In Rotterdam, the SS Spread narrowed by $1.00, dropping from $80.00 last week to $79.00, while the weekly average at the port rose by $1.00. Conversely, in Singapore, the 380 HSFO/VLSFO spread declined by $8.00, falling from $96.00 to $88.00, with the weekly average decreasing by $4.50. Throughout the week, the Global SS Spread and regional indices lacked a clear trend, consistently staying below the $100.00 threshold. We anticipate no significant changes in the SS Spread dynamics next week, with the indicators likely continuing their irregular fluctuations. More detailed information can be found in the "Differentials" section on mabux.com.

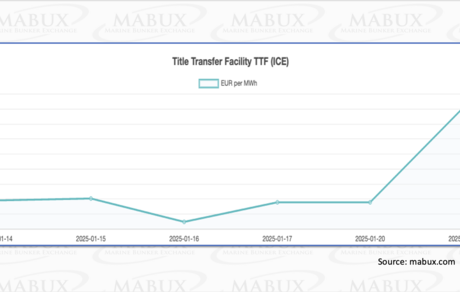

Currently, gas prices, wind power generation, and demand levels show little volatility in the primary European electricity markets. Lower gas prices and increased wind power generation have driven down energy prices in some regional markets, while rising demand has pushed prices higher in others. Meanwhile, the natural gas market is expected to remain resilient and experience an upward trend in the medium term. This is largely attributed to the expansion of global LNG production capacity and the development of import infrastructure, which are solidifying LNG’s role as a key energy source in Europe. As of January 20, European regional storage facilities were 59.38% full (down 5.60% from last week and down 11.95% from the beginning of the year) and the gas withdrawal process was ongoing. At the end of Week 04, the European gas benchmark TTF rose by 3.08 EUR/MWh, exceeding the 50.00 EUR/MWh mark (50.027 EUR/MWh versus 46.947 EUR/MWh last week).

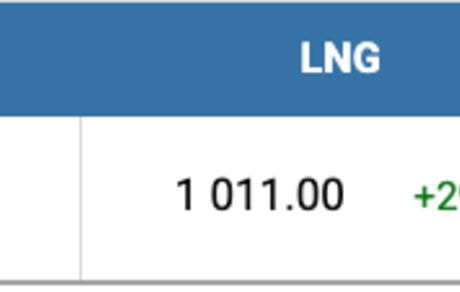

The price of LNG as a bunker fuel in the port of Sines (Portugal) rose by USD 29 over the week, reaching USD 1,011/MT on January 20. Additionally, the price difference between LNG and conventional fuel widened on the same day, with MGO LS priced USD 209 lower than LNG, compared to a difference of USD 175 the previous week. MGO LS was quoted at USD 802/MT in the port of Sines on January 20. More detailed information is available in the LNG Bunkering section on mabux.com.

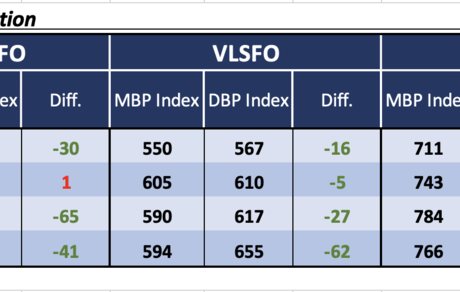

During Week 04, the MABUX Market Differential Index (MDI)—the ratio of market bunker prices (MBP Index) to the MABUX digital bunker benchmark (DBP Index)—registered mixed dynamics across the four major hubs: Rotterdam, Singapore, Fujairah, and Houston.

• 380 HSFO segment: Singapore returned to the overcharge zone, with its weekly average rising by 6 points. The other three ports: Rotterdam, Fujairah and Houston remained undervalued, with underprice levels rising by 36 points in Rotterdam but decreasing by 6 points in Fujairah and 1 point in Houston.

• VLSFO segment: All ports were in the undercharge zone. Weekly averages increased by 4 points in Rotterdam, 1 point in Singapore, and 6 points in Houston, while Fujairah saw a decline of 1 point. The MDI in Singapore remained close to 100% correlation between market price (MBP) and the digital bunker benchmark MABUX (DBP).

• MGO LS segment: Singapore moved back into the undervalued zone, resulting in all ports being underpriced. Weekly averages rose by 1 point in Rotterdam, 9 points in Singapore, 8 points in Fujairah, and 15 points in Houston. The MDI indices in Rotterdam and Singapore remained near the 100% correlation mark between MBP and DBP, whereas Fujairah’s index continued to exceed the $100.00 mark.

In terms of the balance between overvalued and undervalued ports, Singapore shifted to the overcharge zone in the 380 HSFO segment but returned to the undercharge zone in the MGO LS segment. Underpricing of bunker fuel remains the dominant trend in the global bunker market, and we expect this dynamic to persist into next week.

Further insights on the correlation between market prices and the MABUX digital benchmark are available in the Digital Bunker Prices section of mabux.com.

Integr8 Fuels has warned that 45% of global very low sulphur fuel oil (VLSFO) supplies will fail to meet the RM380 requirements of the International Standards Organisation’s ISO 8217:2024 specification without adjustments to blending recipes. These changes, however, could result in a surge of problematic fuels. Singapore and Houston have been identified as "hot spots" for these adjustments, with two-thirds of VLSFO in Singapore requiring reformulation. Integr8 Fuels also flagged VLSFO sulphur compliance as a "pressing issue," noting that 2.4% of supplies exceeded the 95% allowable limits under ISO 8217 Table 2 parameters over the past six months. The report further highlighted the growing adoption of LNG and biofuels to comply with regulations such as FuelEU Maritime. Additionally, the upcoming introduction of the Mediterranean Emission Control Area (Med ECA) on 1 May is expected to drive increased LNG bunkering demand in the region. However, deliveries of LNG bunkering vessels are failing to keep pace with this rising demand, exacerbating challenges in the LNG supply chain.

We expect a moderate downward trend to resume in the global bunker market next week.

By Sergey Ivanov, Director, MABUX