The Bunker Outlook was contributed by Marine Bunker Exchange (MABUX)

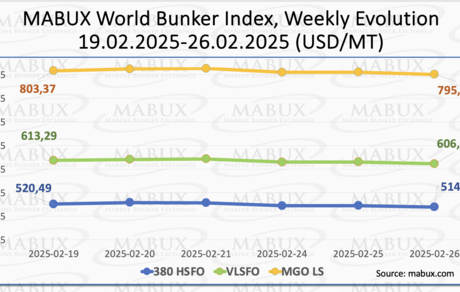

At the end of the 9th week, the MABUX Global bunker indices continued their moderate downward trend. The 380 HSFO index dropped by 6.07 USD, declining from 520.49 USD/MT last week to 514.42 USD/MT, steadily approaching the 500 USD mark. The VLSFO index fell by 7.22 USD, reaching 606.07 USD/MT from 613.29 USD/MT last week, nearing the 600 USD threshold. Meanwhile, the MGO index declined by 7.75 USD, dropping from 803.37 USD/MT last week to 795.62 USD/MT, falling below the 800 USD mark. At the time of writing, a moderate upward correction was observed in the global bunker market.

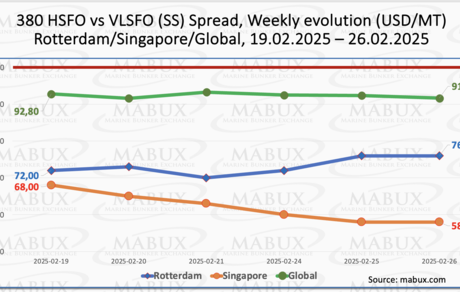

The MABUX Global Scrubber Spread (SS) — the price difference between 380 HSFO and VLSFO — recorded a slight decrease of $1.15, dropping from $92.80 last week to $91.65, remaining below the $100.00 breakeven mark. The weekly average of the index declined by $0.52. In Rotterdam, the SS Spread showed an increase of $4.00, rising from $72.00 last week to $76.00, although the weekly average in the port declined by $1.16. Conversely, in Singapore, the 380 HSFO/VLSFO spread continued its downward trend, decreasing by $10.00 from $68.00 last week to $58.00, with the weekly average falling by $5.50. Overall, the Global SS Spread experienced no significant changes, while regional indices fluctuated in different directions, staying consistently below the $100.00 threshold. The current SS Spread dynamics continue to support the higher profitability of using 380 HSFO fuel over the VLSFO+Scrubber combination. Looking ahead, we expect the SS Spread index to remain volatile without a clear trend. More detailed information is available in the "Differentials" section of mabux.com.

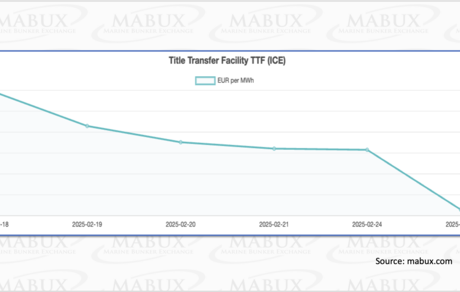

European natural gas futures continue to fluctuate, hovering around €49/MWh, as traders assess the urgent need to replenish storage ahead of next winter. Last week, Germany, France, and Italy proposed easing EU storage requirements to help stabilize the market. Under current European Commission regulations, all EU countries must fill their storage facilities to 90% capacity by November each year, with interim targets set for February, May, July, and September. As of February 25, European regional storage facilities were 40.30% full, reflecting a decrease of 3.07% compared to the previous week and a significant drop of 31.03% since the beginning of the year. The withdrawal of gas from storage continues. At the end of the 9th week, the European gas benchmark TTF maintained its downward trend, declining by 5.624 euros/MWh to 44.291 euros/MWh from 49.915 euros/MWh last week, remaining firmly below the 50.00 euros/MWh threshold.

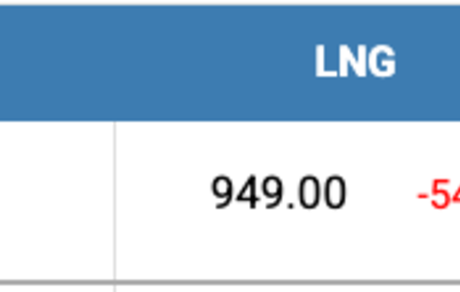

By the end of the week, the price of LNG as a bunker fuel in the port of Sines (Portugal) fell by $54 compared to the previous week, dropping below the $1,000 mark to reach $949/MT on February 25. Simultaneously, the price gap between LNG and conventional fuel on February 25 narrowed, with MGO LS being $177 cheaper than LNG, compared to a $227 difference the previous week. On that day, MGO LS was quoted at $772/MT in the port of Sines. More details can be found in the LNG Bunkering section on mabux.com.

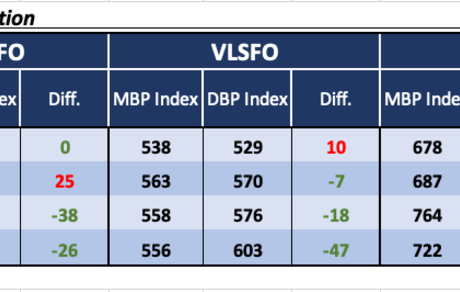

During week 09, the MABUX Market Differential Index (MDI) — which measures the ratio of market bunker prices (MBP Index) to the MABUX digital bunker benchmark (DBP Index) — continued to fluctuate across the four largest global hubs: Rotterdam, Singapore, Fujairah, and Houston.

• 380 HSFO segment: Singapore remained the only overvalued port, with its weekly average decreasing by 2 points. Fujairah and Houston remained underpriced, with Fujairah’s undercharge level increasing by 2 points, while Houston saw a decrease of 3 points. In Rotterdam, the MDI registered a 100% correlation between MBP and DBP.

• VLSFO segment: Singapore moved into the undervalued zone, joining Fujairah and Houston. The weekly averages increased by 9 points in Singapore and 6 points in Fujairah, while Houston’s average declined by 4 points. Rotterdam remained the only overpriced port in this segment, with its average MDI increasing by 2 points.

• MGO LS segment: All four ports were in the undervalued zone. Weekly averages fell by 2 points in Rotterdam, increased by 7 points in Singapore and 1 point in Fujairah, and remained unchanged in Houston. Rotterdam neared a 100% correlation between MBP and DBP, while Fujairah remained comfortably above the $100.00 mark.

The overall balance between overvalued and undervalued ports showed a slight shift toward overvaluation in the 380 HSFO and VLSFO segments. However, the general trend of bunker fuel undervaluation remains dominant.

More detailed information on the correlation between market prices and the MABUX digital bunker benchmark is available in the Digital Bunker Prices section of mabux.com.

The Port of Rotterdam's cargo throughput in 2024 decreased by 0.7% to 435.8 million tonnes, down from 438.8 million tonnes in the previous year. The decline was primarily driven by reduced coal and crude oil throughput. However, the container segment saw growth, increasing by 2.8% to 13.8 million TEU (twenty-foot equivalent units).

In 2024, approximately 743 vessels from 49 shipping lines participated in the Protecting Blue Whales and Blue Skies (BWBS) initiative, a California-based voluntary vessel speed reduction (VSR) program. Celebrating its 10th anniversary in 2024, the program promotes reduced vessel speeds in the Santa Barbara Channel and San Francisco Bay area to protect whales and lower air pollution. Participation increased by 16 vessels compared to 2023. The number of shipping lines receiving the highest award (Sapphire) — granted to those with more than 85% of their total miles traveled in VSR zones at 10 knots or less — nearly doubled from 13 in 2023 to 23 in 2024. Of all traffic passing through VSR zones, container ships accounted for 78%, while auto/Ro-Ro vessels made up 97%.

We expect the global bunker market to maintain its potential for a moderate downward trend next week.

By Sergey Ivanov, Director, MABUX