Veson Nautical, using data from VesselsValue, has confirmed that South Korea's shipbuilding orderbook has exceeded $138 billion, according to Marine Link.

Veson Nautical, using data from VesselsValue, has confirmed that South Korea's shipbuilding orderbook has exceeded $138 billion, according to Marine Link.

The LNG sector is the most valuable, representing $71.3 billion, or about 52% of the total orderbook value. This sector also has the largest volume of orders, with 276 vessels on order.

Container ships follow with a market value of $35.6 billion, making up around 26% of the total, with 184 vessels scheduled for construction.

The LPG sector ranks third with a value of $14.9 billion and 129 vessels on order.

The tanker orderbook is valued at $14.7 billion, with 185 vessels planned for construction, surpassing both the LPG and container ship sectors in order volume.

Vehicle carriers rank fifth, with an orderbook worth $929 million, consisting of eight vessels.

CMA CGM leads the orderbook value, with $8.09 billion in orders, including 38 container vessels in the ULCV, New Panamax, and Post Panamax sectors.

NYK ranks second, with an orderbook of $7.21 billion, comprising 26 large LNG vessels of 174,000 CBM and three VLACs of 88,000 CBM. In addition, NYK has 56 more vessels on order from shipyards in China, Japan, and Germany, covering LNG, LPG, bulkers, and tankers.

Qatar Gas Transport follows in third with an orderbook worth $6.9 billion, consisting of 29 large and Qmax LNG vessels.

Qatar Energy ranks fourth with a $6.52 billion orderbook, primarily consisting of large LNG vessels.

Evergreen Marine Corporation holds the fifth position with a $6.38 billion orderbook, consisting of 28 New Panamax container ships.

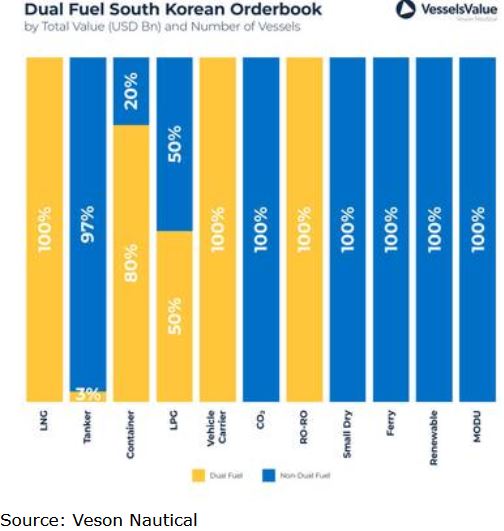

Approximately 37% of the vessels in South Korea’s orderbook are being constructed with dual-fuel capabilities, with a market value of $71.4 billion. This includes LNG carriers, vehicle carriers, and ro-ro ships. In the container sector, 148 dual-fuel vessels have been contracted, representing about 80% of the orderbook. The LPG sector also has a significant dual-fuel presence, with 64 vessels, worth $7.5 billion, being built as dual-fuel.

Among the top shipowners in South Korea, HMM leads with the most valuable fleet, worth $11.9 billion, consisting of 112 vessels across various sectors. H Line Shipping ranks second with a fleet worth $6.09 billion and 62 vessels. Pan Ocean ranks third with a fleet valued at $5.73 billion, although they own the second-largest fleet by volume, with 126 vessels. Sinokor follows with a fleet value of $5.73 billion, but they possess the largest fleet in terms of volume, with 134 vessels.