The global ship recycling sector exhibited varied activity last week, influenced by fluctuating local steel plate prices—rising in India, declining in China, and remaining stable in Bangladesh and Pakistan—according to cash buyer GMS.

In recent weeks, recycling activity in the subcontinent markets has increased, with a notable improvement in deliveries. However, the current week saw a downturn, with no new arrivals in Bangladesh and only one vessel each in India and Pakistan.

GMS observed, "Even Bangladeshi prices that climbed briefly following on a dearth of tonnage, seem to have settled as there is no tonnage to bid on, and Indian and Pakistani recyclers remain cautious and tentative in their offerings on fresh tonnage in light of the recent U.S. sanctions saga."

Recyclers are monitoring the markets to assess the potential impact of renewed dumping of inexpensive Chinese steel into the subcontinent before making new offers, which may be significantly lower in a post-tariff environment.

GMS also noted, "With minimum activity taking place in Bangladesh, Pakistan, and Turkey thanks to Eid celebrations and holidays that have kept most markets closed through this week, the outcome of Bangladeshi restriction on imports remains unresolved on the back of the March 31 deadline for local recyclers within which, infrastructure updates at all domestic ship recycling yards were to commence, leaving the fate of pending deliveries through the upcoming tide(s), an uncertainty."

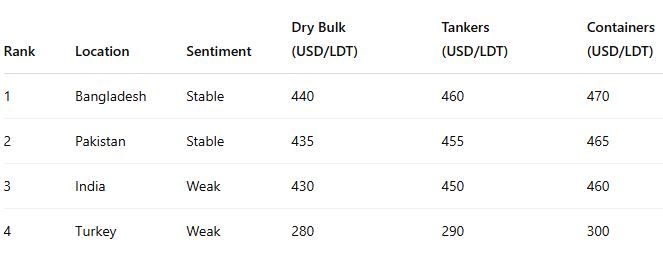

GMS provided the following demo rankings and pricing for week 14 of 2025:

GMS (Global Marketing Systems), founded in 1992, is one of the world's largest cash buyers of ships and offshore assets for recycling. The company is headquartered in Dubai, UAE, and operates globally, facilitating the sale and purchase of vessels for demolition. GMS provides market insights, negotiates deals, and ensures compliance with international regulations and environmental standards in the ship recycling industry.