The Bunker Outlook was contributed by Marine Bunker Exchange (MABUX)

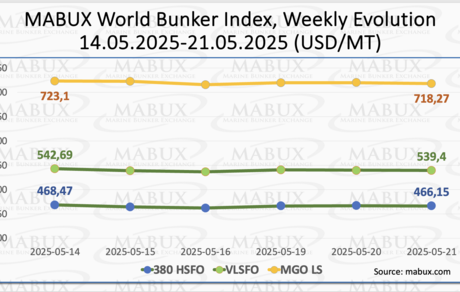

At the end of the 21st week, the global bunker indices from MABUX showed a moderate decline. The 380 HSFO index dropped by 2.32 USD, falling from 468.47 USD/MT the previous week to 466.15 USD/MT. The VLSFO index decreased by 3.29 USD, moving from 542.69 USD/MT to 539.40 USD/MT. The MGO index fell by 4.83 USD, from 723.10 USD/MT last week to 718.27 USD/MT. At the time of writing, the market was showing signs of resuming its upward trend.

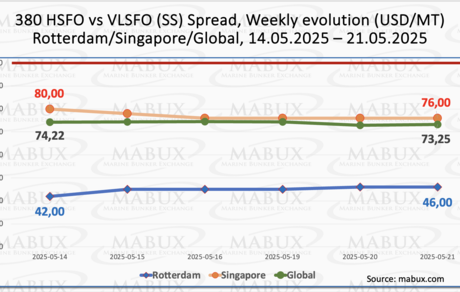

The MABUX Global Scrubber Spread (SS)—the price difference between 380 HSFO and VLSFO—decreased slightly by $0.97, from $74.22 last week to $73.25. Conversely, the average weekly value of the index rose by $2.09. In Rotterdam, the SS Spread increased by $4.00, reaching $46.00 compared to $42.00 the previous week. The average weekly value at the port also rose by $5.33. In Singapore, however, the 380 HSFO/VLSFO price differential narrowed by $4.00, declining from $80.00 last week to $76.00. The average weekly value in Singapore similarly dropped by $4.83. There remains no clear trend in the dynamics of global and port-specific SS Spread indices, with values continuing to fluctuate. Nonetheless, all indices remain well below the $100.00 breakeven threshold, which continues to favor the higher profitability of using conventional VLSFO over the 380 HSFO + scrubber combination. We anticipate the current SS Spread dynamics to persist into next week. More detailed information can be found in the "Differentials" section of mabux.com.

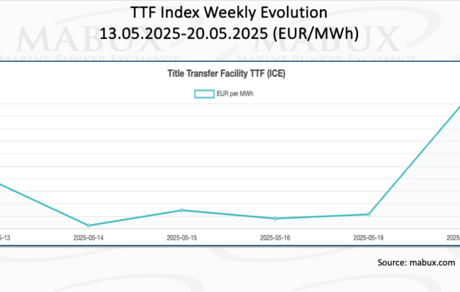

The EU is expected to spend approximately €10 billion more this year to refill its gas storage facilities. This increase in costs stems from a colder-than-average winter in 2024–25, which significantly depleted the region's natural gas reserves—more so than during the previous two, milder winters. By the end of the season, storage levels had dropped to nearly 30%, marking the steepest decline in recent years. To restore storage to comfortable levels, the EU will need to ramp up its purchases of liquefied natural gas.

As of May 20, European regional gas storage facilities were 44.91% full—an increase of 1.78% from the previous week, but a significant decrease of 26.42% compared to the beginning of the year (71.33%). The gradual process of refilling storage continues. By the end of the 21st week, the European gas benchmark TTF maintained its moderate upward trend, rising by 1.235 euros/MWh to reach 36.979 euros/MWh, up from 35.744 euros/MWh the previous week.

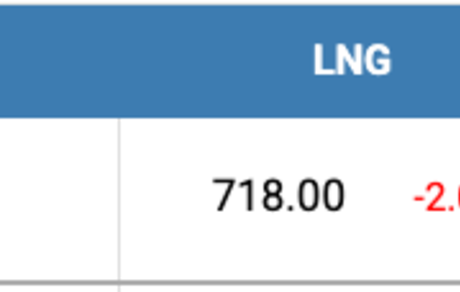

By the end of the week, the price of LNG as a bunker fuel in the port of Sines (Portugal) declined by another $2, reaching $718/MT compared to $720/MT the previous week. Meanwhile, the price gap between LNG and conventional fuel narrowed to $43 in favor of conventional fuel, down from $47 the week before. On May 21, MGO LS was quoted at $675/MT in the port of Sines. More detailed information is available in the LNG Bunkering section on the mabux.com website.

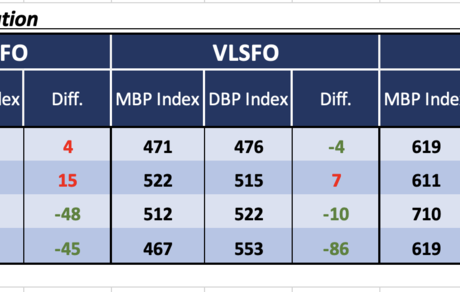

At the end of the 21st week, the MABUX Market Differential Index (MDI)—which compares market bunker prices (MBP) with the MABUX Digital Bunker Benchmark (DBP)—showed the following trends across the 380 HSFO, VLSFO, and MGO LS segments:

• 380 HSFO segment: Rotterdam and Singapore remained overvalued. The weekly average MDI was unchanged in Rotterdam and increased by 3 points in Singapore. Fujairah and Houston continued to be undervalued, with the average MDI rising by 5 points in both ports. Notably, Rotterdam stayed close to the 100% correlation level between MBP and DBP.

• VLSFO segment: Singapore was the only overvalued port, with the average MDI falling by 4 points. Rotterdam, Fujairah, and Houston remained undervalued: MDI dropped by 7 points in Rotterdam and 1 point in Houston, while it increased by 2 points in Fujairah. Rotterdam and Singapore are approaching full (100%) MBP/DBP correlation.

• MGO LS segment: Rotterdam remained the only overvalued port, with the weekly average MDI rising by 2 points. The other three ports—Singapore, Fujairah, and Houston—were undervalued. MDI rose by 4 points in Singapore, 17 points in Fujairah, and 10 points in Houston. Rotterdam remained close to 100% MBP/DBP correlation.

There were no changes in the overall overvaluation/undervaluation structure during the week. No significant adjustments are expected in this balance next week. For more information on the correlation between market prices and the MABUX Digital Benchmark, please visit the Digital Bunker Prices section on mabux.com.

According to a recent report by the NGO Solutions for Our Climate (SFOC), the global liquefied natural gas (LNG) fleet is responsible for approximately 12.7 billion metric tons of carbon dioxide equivalent (COŌéée) emissions annually. This figure includes both direct emissions from ship operations and significantly larger lifecycle emissions associated with LNG production, liquefaction, transportation, regasification, and combustion. While shipping companies typically report only operational emissions, they omit the far greater lifecycle emissions of the LNG they transport, leading to a substantial underreporting of global greenhouse gas emissions. The SFOC report also highlights the rapid growth of the LNG shipping sector: since 2014, the global fleet has tripled to 1,032 vessels, with an additional 324 under construction. These new ships are expected to remain in service for at least 30 years, raising concerns about stranded assets and an oversupplied market.

We anticipate that the global bunker market may resume a moderate upward trend next week.

By Sergey Ivanov, Director, MABUX