The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

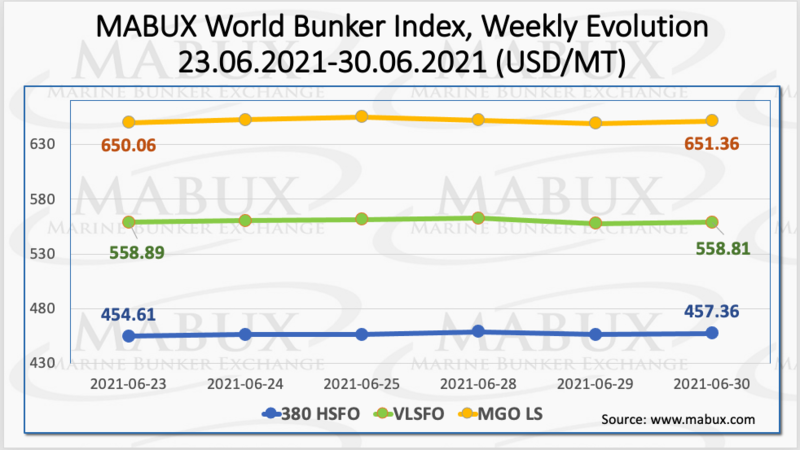

During Week 26, MABUX World Bunker Index did not show significant changes. The 380 HSFO index rose by 2.75 USD: from 454.61 USD/MT to 457.36 USD/MT, the VLSFO index lost 0.08 USD: from 558.89 USD/MT to 558.81 USD/MT, while the MGO index added 1.30 USD (from 650.06 USD/MT to 651.36 USD/MT).

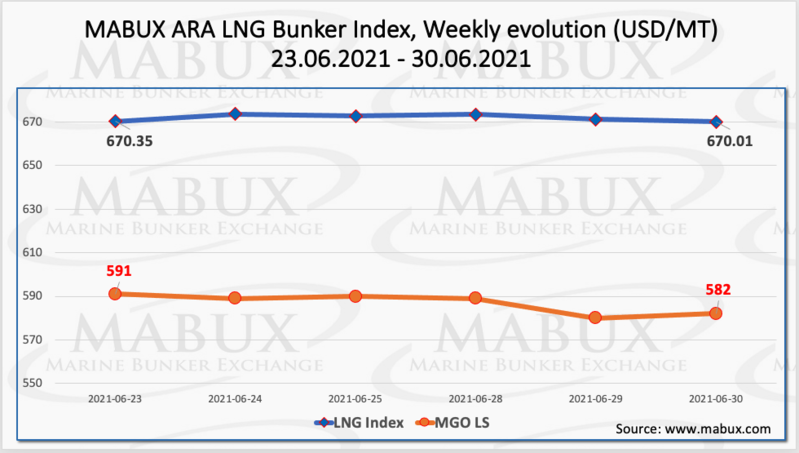

European gas market prices have rallied during last two weeks. Summer gas prices reached record levels on lower supply of gas and demand for storage injections. MABUX ARA LNG Bunker Index - the average price of LNG as a marine fuel in the ARA region, remained practically unchanged from June 23 to June 30: slightly down from 670.35 USD/MT to 670.01 USD/MT. At the same time, the average value of LNG Bunker Index rose by 39.34 USD compared to the previous week. The average price for MGO LS in Rotterdam has decreased by 9.00 USD/MT during the same period. Meantime, the average price difference between bunker LNG and MGO LS in Rotterdam increased by 33.67 USD and is at 85.06 USD (versus 51.39 USD last week). More information is available in the new LNG Bunkering section at www.mabux.com.

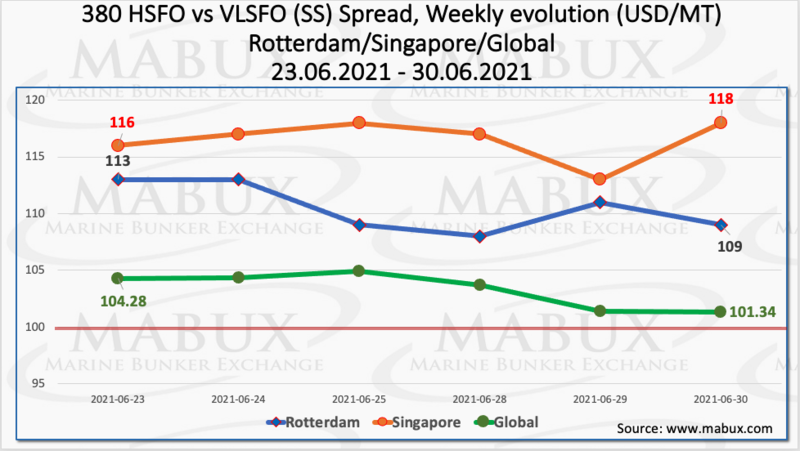

The average weekly Global Scrubber Spread (SS) - the difference in price between 380 HSFO and VLSFO - has not changed during the week and is still above the psychological mark of $ 100: $ 103.33 (versus $ 103.30 last week). At the same time, the average value of SS Spread in Rotterdam increased by $ 2.17 and reached $ 110.50 (vs. $ 108.33 last week). In Singapore, the average SS Spread has not changed and remained at USD 116.50. The SS Spread averages in both ports remain above the $ 100 mark. More information is available in the Differentials section at www.mabux.com.

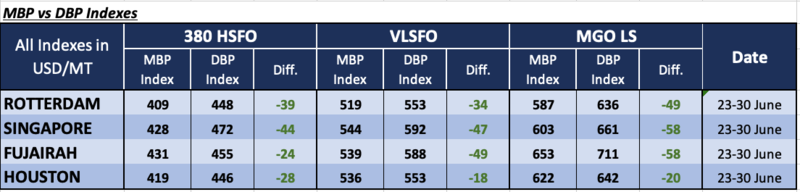

Correlation of MABUX MBP Index (Market Bunker Prices) vs MABUX DBP Index (MABUX Digital Benchmark) in the four global largest hubs during the past week showed that 380 HSFO fuel remained undervalued in all four selected ports ranging from minus $ 28 in Houston (versus minus $ 30 a week ago) and minus $ 24 in Fujairah (versus minus $ 21) to minus $ 39 in Rotterdam (unchanged) and minus $ 44 in Singapore (versus minus $ 50). The most significant change in HSFO's MBP / DBP Index 380 was registered in Singapore (underpricing up $ 6).

VLSFO fuel, according to the MABUX DBP Index, was also underestimated in all four selected ports: in Houston the underpricing was minus $ 18 (minus $ 19 last week), in Rotterdam - minus $ 34 (unchanged), in Fujairah - minus $ 49 (versus minus $ 48), in Singapore - minus $ 47 (versus minus $ 50). The VLSFO MBP / DBP Index for all selected ports remained virtually unchanged.

As for MGO LS, MABUX DBP Index has registered an undercharge of this grade at all selected ports ranging from minus $ 20 (unchanged from last week) in Houston to minus $ 49 (unchanged) in Rotterdam, minus $ 58 (vs. minus $ 61) in Singapore and minus $ 58 (unchanged) in Fujairah. The MBP / DBP Index correlation for MGO LS fuel also remains stable.

German environmental group NABU said, the results from a study on the potential of ammonia as bunkers show that ammonia as a marine fuel has a high potential for climate protection if nitrous oxide generated during the combustion is eliminated. The study found that, from an air pollution angle, ammonia is ‘recommendable’ if harmful nitrogen oxide emissions are also addressed, while from a safety perspective, ‘strict’ regulations are required to prevent leakage owing to the highly toxic nature of the fuel. The study also found that even if ammonia is not widely used as a fuel in shipping, investments in ammonia infrastructure will not be a stranded assets as ammonia will play an important role in the decarbonisation of other sectors in the hydrogen economy. The ‘timely’ financial and legal promotion of green ammonia production under the necessary environmental and safety requirements would therefore be a ‘no-regret decision’ for climate protection in contrast to today’s decisions for LNG use and infrastructure, NABU said.

Source: www.mabux.com

All news