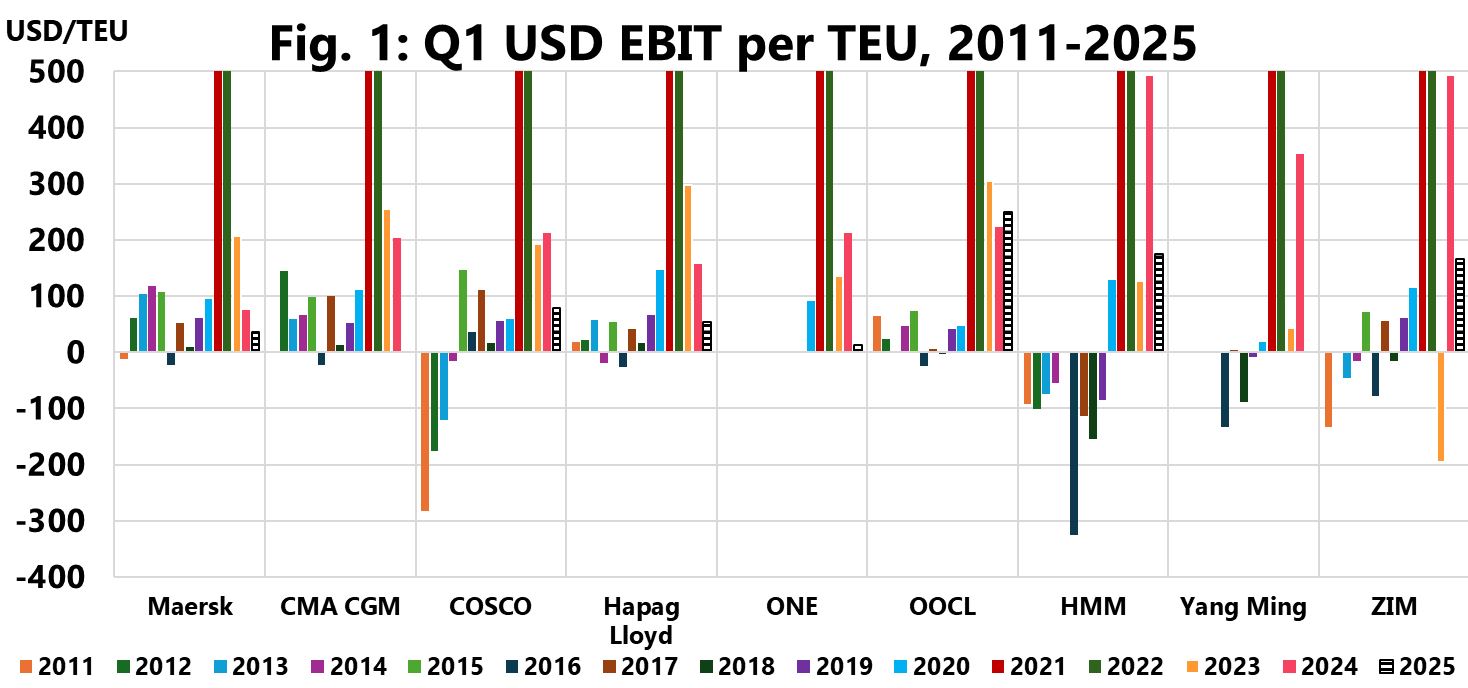

In the first quarter of 2025, major shipping lines reported a combined EBIT of USD 5.89bn, a result second only to the pandemic-era first quarters of 2021–2023, according to Sea-Intelligence.

In the first quarter of 2025, major shipping lines reported a combined EBIT of USD 5.89bn, a result second only to the pandemic-era first quarters of 2021–2023, according to Sea-Intelligence.

In the second quarter of 2025, however, market disruptions, shifting volumes, and continued downward pressure on freight rates reduced combined EBIT to USD 2.73bn. This figure was lower than in the second quarter of 2021–2024 and only marginally higher than in 2020, indicating weaker profitability compared to most recent years.

The EBIT/TEU indicator, used to measure operational profitability in container shipping, showed positive results across all major carriers. Figures ranged from 12 USD/TEU at ONE to 249 USD/TEU at OOCL.

Three companies reported less than 100 USD/TEU: Maersk at 35, Hapag-Lloyd at 53, and COSCO at 79. HMM reported 176 USD/TEU and ZIM 167. Data for Yang Ming and CMA CGM was incomplete, as they had not yet published Q2 2025 volumes and EBIT respectively.

Financial reports also highlighted divergent trends across trades. The Asia-Europe market saw strong growth, with three of the six lines reporting double-digit year-on-year increases in volume, while the Transpacific market registered widespread contractions.