The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

Over the Week 20, the MABUX global bunker indices continued modest decline. The 380 HSFO index decreased by 2.27 USD: from 546.81 USD/MT last week to 544.54 USD/MT. The VLSFO index dropped by 1.27 USD (658.35 USD/MT versus 659.62 USD/MT last week). The MGO index fell by 5.92 USD (from 846.30 USD/MT last week to 840.38 USD/MT). At the time of writing, there was a moderate upward correction observed in the global bunker market.

The MABUX Global Scrubber Spread (SS) - the price difference between 380 HSFO and VLSFO - showed a slight increase, reaching plus $1.00 ($113.81 versus $112.81 last week), still hovering close to the $100.00 mark (SS Breakeven), while the weekly average decreased by $2.31. In Rotterdam, SS Spread continued its decline: minus $2.00 (from $88.00 last week to 86.00), consistently below the $100 mark. The port's weekly average also dropped by $5.50. Conversely, in Singapore, the 380 HSFO/VLSFO price spread increased by $8.00 ($105.00 vs. $97.00 last week), once again surpassing the $100 mark, with the weekly average increasing by $2.67. Currently, there is no pronounced dynamics in SS Spread, while indicators in both ports are close to the SS breakeven mark. We expect irregular changes in SS Spread to persist next week. More information is available in the "Differentials" section of www.mabux.com.

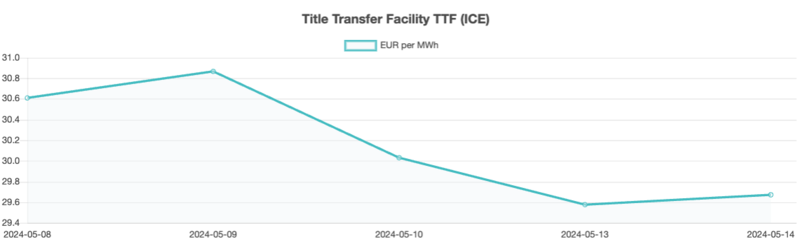

Forecasts indicate that prematurely phasing out cleaner and more economically advantageous natural gas could result in significant price fluctuations, triggering energy security and affordability challenges. This instability in prices may serve as an impetus to detach the energy infrastructure from unpredictable fuel markets, embrace renewable alternatives, and propel the energy transition forward. However, in the short run, volatility could impede progress. In week 20, the European gas benchmark TTF continued to decline, falling by 0.94 EUR/MWh (29.669 EUR/MWh versus 30.609 EUR/MWh last week).

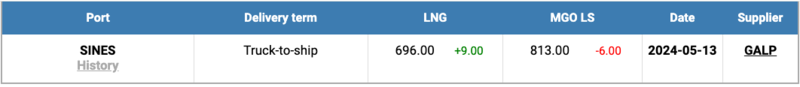

The price of LNG as bunker fuel at the port of Sines (Portugal) experienced a slight uptick, reaching 696 USD/MT on May 13, marking a rise of 9 USD compared to the previous week. Conversely, the price differential between LNG and conventional fuel decreased on May 13, now standing at 117 USD in favor of LNG (compared to 128 USD a week earlier). On that same day, MGO LS was listed at 813 USD/MT in the port of Sines. More information is available in the LNG Bunkering section of www.mabux.com.

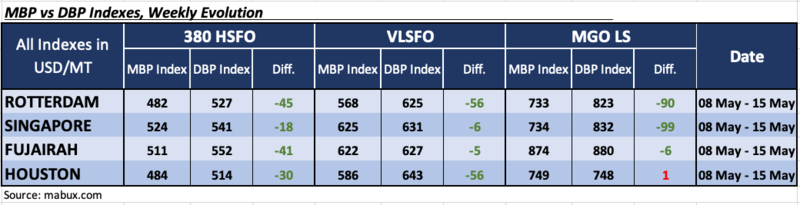

In Week 20, the MDI index (the ratio of market bunker prices (MABUX MBP Index) vs. MABUX digital bunker benchmark (MABUX DBP Index)) observed the following trends across the major world hubs: Rotterdam, Singapore, Fujairah and Houston:

In the 380 HSFO segment, all selected ports remained in the undercharge zone. Weekly averages fell 5 points in Rotterdam and 3 points in Fujairah, while rising by 1 point in Singapore. The MDI index in Houston remained unchanged.

In the VLSFO segment, according to the MDI, all ports were undervalued, with average weekly levels increasing by 1 point in Rotterdam and 3 points in Houston but decreasing by 3 points in both Singapore and Fujairah. Indices for Singapore and Fujairah remained closely aligned with the 100 percent correlation mark between market price and the MABUX digital benchmark.

In the MGO LS segment, Houston remained the only overvalued port, with the weekly average falling by 10 points, and the index itself approaching 100% correlation between market price and the MABUX digital benchmark. All other ports were undervalued. Average weekly levels showed a further 4 points decline in Rotterdam and 7 points in Fujairah, but an 11 point increase in Singapore.

At week's end, the balance of overvalued/undervalued ports across all market segments remained unchanged, with no steady trend in the dynamics of the MDI index.

For more details on the correlation between market prices and the MABUX digital benchmark, visit the “Digital Bunker Prices” section on www.mabux.com.

A recent study conducted by Chalmers University of Technology in Sweden has shed light on a concerning trend within the shipping industry. The research reveals that instead of opting for cleaner fuel options, many shipping companies are capitalizing on the financial benefits of using cheap heavy fuel oil. This decision comes with significant environmental consequences, as vessels equipped with scrubbers contribute to pollution levels equivalent to socio-economic costs surpassing €680 million between 2014 and 2022. The study further indicates that the majority of shipping firms that invested in scrubbers have already surpassed their break-even point, collectively accumulating a surplus of €4.7 billion by the conclusion of 2022 across approximately 3,800 vessels. Notably, over 95% of the commonly used open-loop scrubber systems are paid off within five years. In response to growing environmental concerns, Denmark has recently taken steps to prohibit the discharge of scrubber water within 12 nautical miles of its coastline. Similar measures have been adopted by several other countries, including Germany, France, Portugal, Turkey, and China. While Sweden currently lacks a comprehensive ban, certain ports such as the Port of Gothenburg have implemented restrictions on the discharge of scrubber water within their jurisdiction.

We expect that the downward trend retains its potential in the global bunker market. Next week, global bunker indices may continue their moderate decline.

By Sergey Ivanov, Director, MABUX

All news