The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

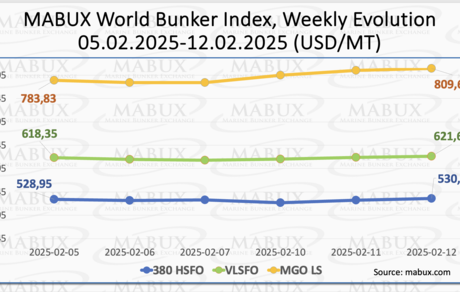

During Week 07, the MABUX global bunker indices saw moderate growth. The 380 HSFO index increased by 1.73 USD, rising from 528.95 USD/MT last week to 530.68 USD/MT. The VLSFO index climbed by 3.26 USD, reaching 621.61 USD/MT from 618.35 USD/MT. The MGO index recorded the most significant gain, adding 25.83 USD to break the 800 USD mark, rising from 783.83 USD/MT to 809.66 USD/MT. As of this writing, the bunker indices have entered a phase of slight downward correction.

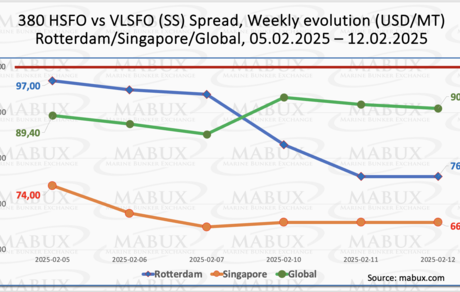

MABUX Global Scrubber Spread (SS) - the price difference between 380 HSFO and VLSFO - continued to widen moderately: plus $1.53 (from $89.40 last week to $90.93), gradually approaching the $100.00 mark (SS Breakeven). The weekly average value of the index saw a marginal increase of $0.71. In Rotterdam, the SS Spread narrowed sharply by $21.00, dropping from $97.00 to $76.00, remaining firmly below the $100.00 threshold. The weekly average in the port also decreased by $4.84. In Singapore, the 380 HSFO/VLSFO price difference declined by $8.00, falling from $74.00 last week to $66.00, while the weekly average dropped by $14.83. While the Global SS Spread remained stable throughout the week, regional indices continued to contract well below the $100.00 mark, further reducing the profitability of the 380 HSFO + Scrubber combination. We expect the SS Spread dynamics to remain largely unchanged next week. For more details, visit the Differentials section at www.mabux.com.

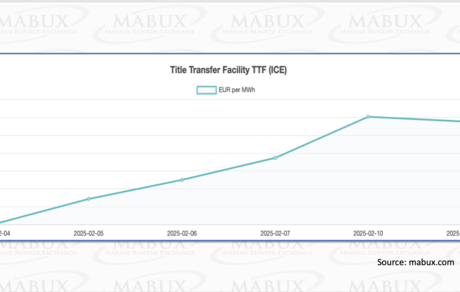

Many of Northern Europe's largest economies have significantly increased gas-fired power generation in 2025, driving regional gas prices to their highest levels since early 2023. In January, gas-fired power generation in Germany, the UK, the Netherlands, and Poland rose by more than 10% compared to the same month in 2024, reaching its highest January level since at least 2022. As of February 11, European regional storage facilities were 47.89% full, marking a decrease of 4.08% from the previous week and 23.44% since the beginning of the year. The gas withdrawal process remains active. At the end of the seventh week, the European gas benchmark TTF continued its upward trend amid stable demand, rising by 5.718 euros/MWh and edging closer to the 60.00 euros/MWh mark (57.766 euros/MWh compared to 52.048 euros/MWh the previous week).

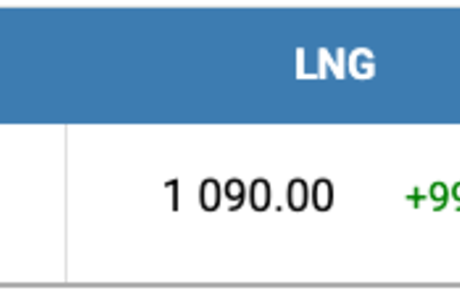

The price of LNG as bunker fuel in the port of Sines (Portugal) saw a sharp increase of USD 99 over the week, reaching USD 1,090/MT on February 10. Simultaneously, the price gap between LNG and conventional fuel widened: on February 10, MGO LS was priced USD 317 lower than LNG, up from a USD 221 difference the previous week. MGO LS was quoted at USD 773/MT in the port of Sines on that day. For more details, visit the LNG Bunkering section on www.mabux.com.

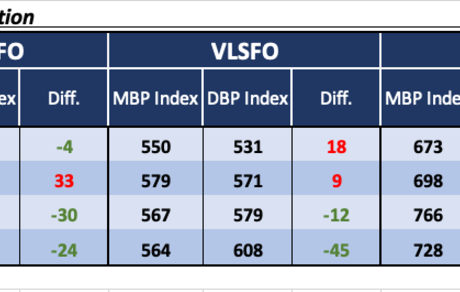

During Week 07, the MABUX Market Differential Index (MDI)— which compares market bunker prices (MBP Index) to the MABUX digital bunker benchmark (DBP Index)—showed mixed trends across the four major hubs: Rotterdam, Singapore, Fujairah, and Houston.

• 380 HSFO segment: Singapore remained the only overvalued port, with the weekly average overcharge rising by another 12 points. Meanwhile, Rotterdam, Fujairah, and Houston remained undervalued, with weekly averages decreasing by 10, 13, and 13 points, respectively.

• VLSFO segment: Rotterdam and Singapore were overcharged, with weekly averages up 4 points in Rotterdam but down 1 point in Singapore. Fujairah and Houston remained undervalued, with index values unchanged in Fujairah and a 9-point drop in Houston.

• MGO LS segment: All ports were in the undervalued zone. The weekly average increased by 5 points in Rotterdam, 8 points in Singapore and 5 points in Fujairah but dropped by 13 points in Houston. In Rotterdam, the MDI index remained near the 100% correlation mark between the market price (MBP) and the MABUX digital bunker benchmark (DBP), while Fujairah’s index reached the $100.00 mark.

The overall balance of overvalued and undervalued ports remained largely unchanged during the week, with the global bunker market continuing its trend toward undervaluation. We anticipate that the MDI index balance will remain relatively stable next week, without any significant shifts.

Further insights on the correlation between market prices and the MABUX digital benchmark are available in the Digital Bunker Prices section of www.mabux.com.

A report by the European Maritime Safety Agency (EMSA) and the European Environment Agency (EEA) highlights ongoing environmental challenges in maritime activities, including cargo handling, container shipping, commercial fishing, tanker and cruise operations, and port activities. Shipping accounts for 3-4% of the EU’s total CO2 emissions and contributed 14.2% of the transport sector's emissions in 2022. Methane (CH4) emissions more than doubled between 2018 and 2023, making up 26% of transport-related methane emissions in 2022, largely due to increased LNG use as a marine fuel. Sulphur oxide (SOx) emissions have dropped by about 70% since 2014, thanks to the introduction of Sulphur Emission Control Areas (SECAs) in Northern Europe. The Mediterranean SECA (effective May 2025) and new SOx and NOx controls in the North-East Atlantic are expected to further reduce emissions. However, nitrogen oxide (NOx) emissions rose by 10% between 2015 and 2023, with the transport sector contributing 39% of NOx emissions in 2022. While the use of alternative fuels and energy sources has increased, production must significantly expand to meet rising demand. Additionally, ensuring a well-trained maritime workforce in decarbonization technologies is crucial for sustainable progress.

We anticipate that, amid escalating trade and economic tensions between the U.S. and Canada/Mexico in North America, as well as with Western Europe and China, global bunker indices will maintain their potential for further growth next week.

By Sergey Ivanov, Director, MABUX